US markets rallied on Friday pushing equity markets into record territory levels. The momentum continued to favour the bulls on Monday as Asian markets and US markets continued to advance on the back of what seems to be an imminent rate cut from the FED. The tech heavy Nikkei and Shanghai CSI 300 advanced 0.2% and 0.41% respectively, the Hang Seng advanced 0.29% whilst the ASX200 closed the cash session in the red posting a loss of 0.65%.

The continued battle between America and China continued to rear its ugly head as China posted a weak GDP reading of 6.2% on Monday. The Chinese authorities anticipate that the market will continue to contract if the ongoing trade war persists. The PBOC have already stepped in and have indicated to the market that they will take any necessary action through open market operations to provide relief for the market. Interest rates in mainland China have already come into play this year, with the PBOC cutting rates and is likely to reduce commercial bank reserve requirements in a bid to bolster production and exports. The market is watching with bated breath key numbers out of the US this week which could potentially keep the FED in a corner and force them to act sooner rather than later.

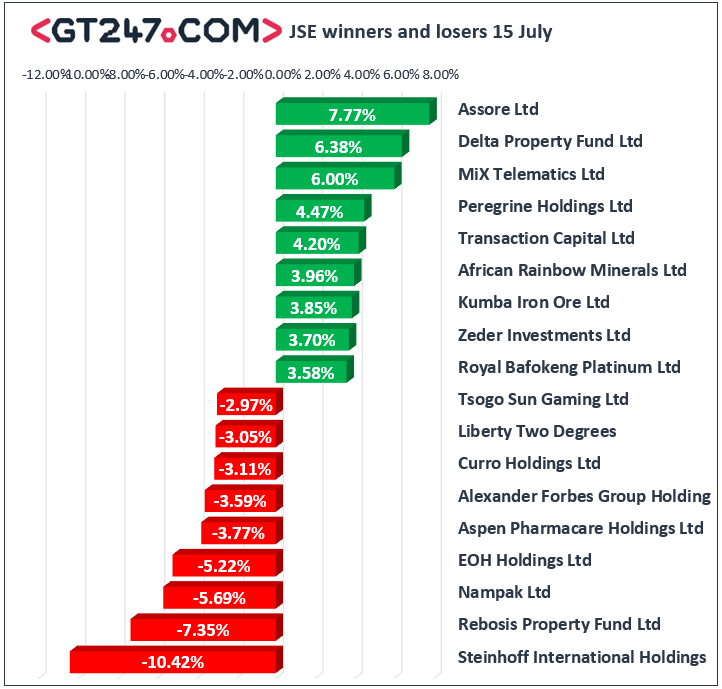

Gains were posted by resource counters as Assore Ltd [JSE:ASR] advanced 7.77% on the day to trade at 37410c, Delta Property Fund Ltd [JSE:DLT], advanced 6.38% whilst MIX Telematics Ltd [JSE:MIX], Peregrine Holdings Ltd [JSE:PGR] and Transactional Capital [JSE:TCP] advanced 6%, 4.47% and 4.2% respectively..

Steinhoff International [JSE:SNH], eased 10.42% as the market continues to apply pressure on the embattled former retail giant. Losses were recorded by Rebosis [JSE:REB], Nampak [JSE:NPK], and EOH [JSE:EOH], which shed 7.35%, 5.69% and 5.22% respectively. Aspen Pharmacare [JSE:APN], shed some of the gains posted last week as it eased 3.77% to close the day at 10177c/ share.

The JSE All-Share index closed 0.27% firmer whilst the JSE Top-40 index gained 0.5%. The Resource index rallied adding 0.41%, the Industrials were firmer inching up 0.83% whilst the Financials only eased 0.32%.

At 17.00 CAT, Palladium was 1.05% firmer to trade at $1558/Oz, Platinum was also firmer adding 1.68% to trade at $848/Oz, Gold advanced on Monday to trade 0.05% firmer to trade at $1412.75/Oz.

Brent crude continued to slide on Monday easing to $66/barrel as geopolitical concerns appear to have been subdued. Iran remains a threat to the movement of tankers within the gulf and ultimately a threat to the supply of crude in the market.

The local unit continued to strengthen against the dollar reaching a session low of 13.85. At 17:00 CAT the Rand was trading at R13.90 against the USD, R15.75 to the Euro and R17.56 to the Pound Sterling.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.