25/08/2017

Standard Bank [JSE:SBK] - Technical Take – update – Stopped out.

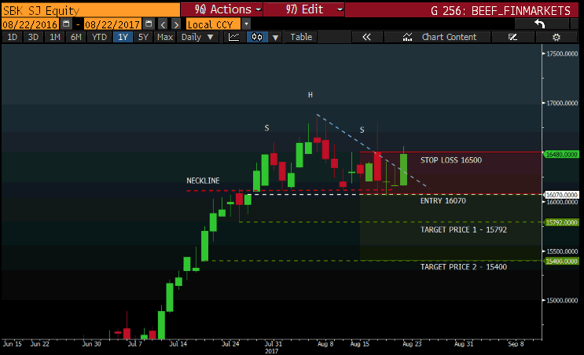

The roller-coaster which is Standard bank (SBK) is finally over, entry at 16070c was triggered on 17/08/2017 and tested the 16070c again the following day and still did not break lower. The head and shoulders pattern did not playout and I eventually got stopped out on 22/08/2017 for a loss at my stop level 16500c.

On to the next one.

18/08/2017

Standard bank delivered much more excitement yesterday 17 August before it triggered as the bank released their results came out seeing the price rally significantly and it seemed that the head and shoulders pattern was no longer in play. The rally did not last long and we saw the price move lower and triggered the short trade at 16070c.

16/08/2017

Standard Bank Technical - Short (Sell)

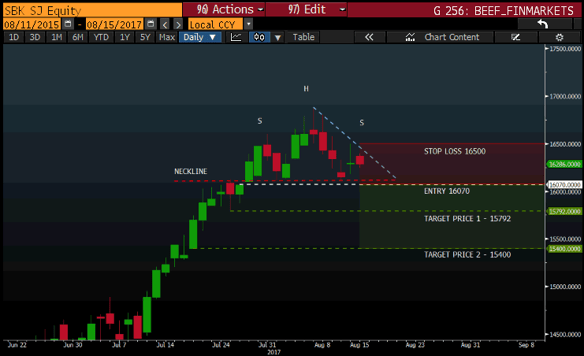

The mighty head and shoulders pattern has made yet another appearance and this time I am looking to sell (short) STANDARD BANK GROUP LIMITED (SBK) at 16070c

Please take note that the pattern is not complete and it has to break the neckline and preferably close below the neckline before entering the trade. I am going to be a little more adventurous on this one and enter the trade as soon as the neckline is broken.

The pattern can be seen more clearly on a 4-hour time frame than on the daily as depicted on the graph above.

TRADE SUMMARY:

- ENTRY (Sell): 16070c

- STOP: 16500c

- TARGET PRICE 1: 15792c

- TARGET PRICE 2: 15400c

Always remember to apply your risk management measures before placing your trades as this will keep you trading in the markets.

Read more notes by Barry HERE.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108