17 October 2017

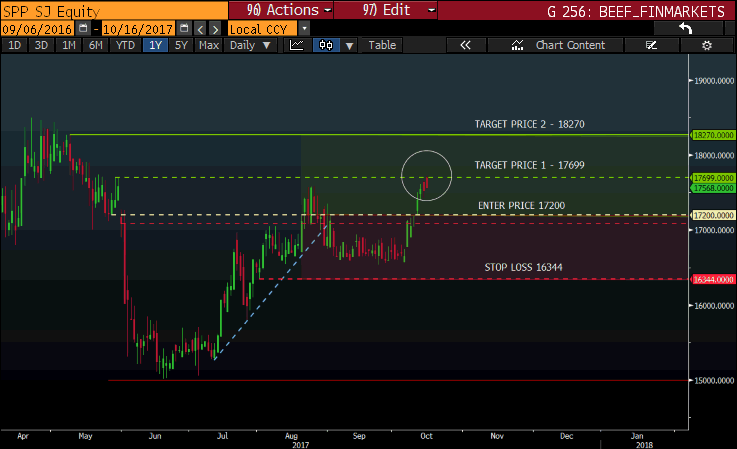

Taking profits - Target price 1 reached on Spar [JSE:SPP]

My Spar group Limited (SPP) trade that I put out on the 22nd of August has finally reached its first target price yesterday the 17th of October.

The price might retrace from the current levels as traders are taking profits but the longer-term view for Spar Group Limited (SPP) is looking good at this stage of the race.

I will be managing my stop loss from here if the price moves higher but at this stage I will keep it at 16344c.

Chart Source: Bloomberg

22 August 2017

Spar Group Limited [JSE:SPP] vs Pick n Pay Stores Limited [JSE:PIK]

The rally in the retail stocks we saw yesterday presented two trade opportunities, so let’s see which one comes out “Tops”, excuse the pun.

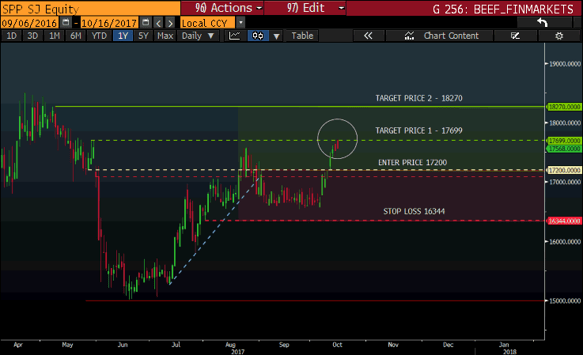

1.The Spar Group Limited (SPP)

I had my eye on this company and yesterday The Spar Group Limited (SPP) broke through resistance and closed above 17000c. This is a good opportunity to go long (buy) and enter your trade. Some retracement can happen in the morning so make sure your risk management is in place.

TRADE: The Spar Group Limited (SPP)

- ENTRY: Long (Buy): 17200c

- STOP: 16344c

- TARGET PRICE 1: 17699c

- TARGET PRICE 2: 18270c

Source - Bloomberg

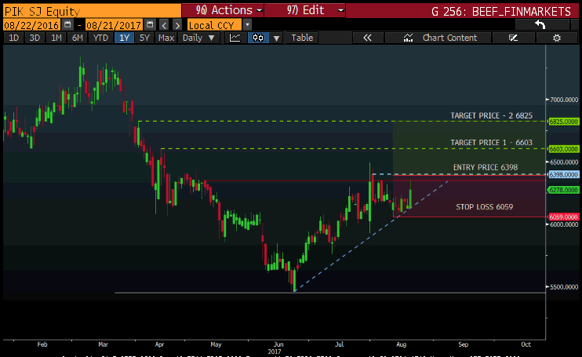

2. Pick n Pay Stores Limited (PIK)

With the Pick n Pay Stores Limited (PIK) opportunity I am waiting for a close preferably above my entry of 6398c before placing my buy (long) trade. Price might also retrace from yesterday so make sure your risk measures are in place.

TRADE: Pick n Pay Stores Limited (PIK)

- ENTRY: Long (Buy): 6398c

- STOP: 6059c

- TARGET PRICE 1: 6603c

- TARGET PRICE 2: 6825c

Source - Bloomberg

Always remember to apply your risk management measures before placing your trades as this will keep you trading in the markets.

Read more notes by Barry HERE.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108