Recommendation: BUY AGAIN AFTER A PULLBACK

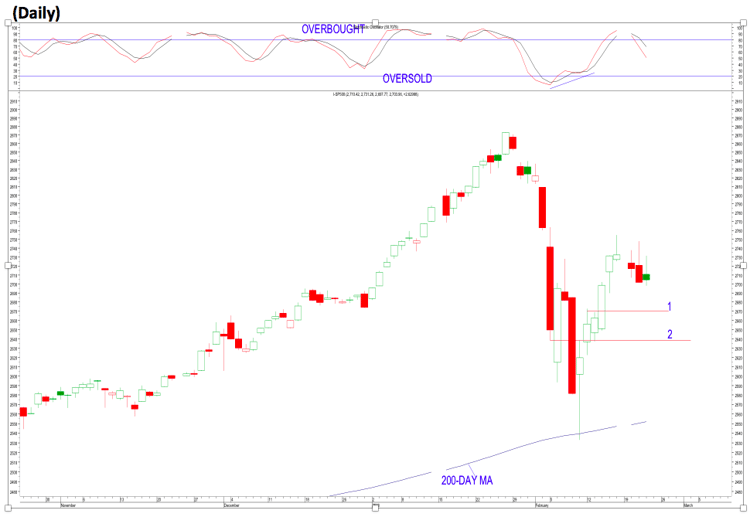

Current Trend: Short-term technically still down. Med-term sideways. Long-term up.

Strategy: Buy again on a pullback to/near line 1, on a reversal day up from there.

Chart Setup: The S&P had a good rebound rally into our target price zone. It then gave a bearish reversal candle (‘shooting star’) on last Friday night and is pulling back so far. I'm looking for more of a pullback before it heads up again. The odds greatly favour the low being ‘in’ (9th Feb).

- Short-term Stochastic is pulling back from its overbought zone, and is not yet oversold.

Strategy Details: Buy (go long) again on from (or near) a support zone formed by lines 1 and 2 (2672-2640, respectively). Wait for a reversal day/candle up from there to enter.

Target: Besides the pullback potential to lines 1 and 2; to the upside thereafter take half profits at 2792. And more at 2850 if reached. There’s a reasonably good chance it makes its way back to a new all time high.

Stop-loss: A close below 2600 when buying after the correction. Once it trades back above 2710 raise the stop to the low of the correction, and from 2775 raise a trailing stop to a breaking of its prior two-day low.

To subscribe to more research by Colin please go to his website www.themarket.co.za

COPYRIGHT:

THIS NEWSLETTER IS TO BE READ ONLY BY CLIENTS OF GLOBAL TRADER. UNDER NO CIRCUMSTANCES IS IT TO BE SHOWN (OR GIVEN) IN PHYSICAL OR ELECTRONIC FORM TO ANY OTHER PERSON, WITHOUT THE PRIOR CONSENT OF THEMARKET.CO.ZA. FURTHERMORE, ELECTRONIC TRANSMISSION (EMAIL), REPRODUCING, AND/OR DISSEMINATING THIS DOCUMENT (OR PART THEREOF) IN ANY OTHER MANNER WITHOUT THE WRITTEN CONSENT OF THEMARKET.CO.ZA IS A VIOLATION OF THE COPYRIGHT LAW - AND IS ILLEGAL.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108