State Owned Enterprises (SOEs), new (but old) political leaders and Eskom’s new CEO are some of the headlines dominating on the local scene.

On the economic news front, we have local Consumer Price Index (CPI) data expected today and the main event on Thursday which is the Interest Rate decision.

On the international front we have the U.S. Federal Reserve's Federal Open Market Committee (FOMC) meeting minutes scheduled to be released at 21:00 SAST.

The Rand

The Rand (ZAR) stood firm despite all the political news and gained momentum against the U.S Dollar (USD). This was mainly as trade negotiations made the rounds again and the losses some ground against other currencies.

The USDZAR currency pair is still above the 14.67 support level which has become a focal point over the last couple of weeks. We might expect some volatility on the currency pair this week with the FOMC meeting minutes later tonight, ongoing U.S-China trade negotiations.

Source - Bloomberg

Source - Bloomberg

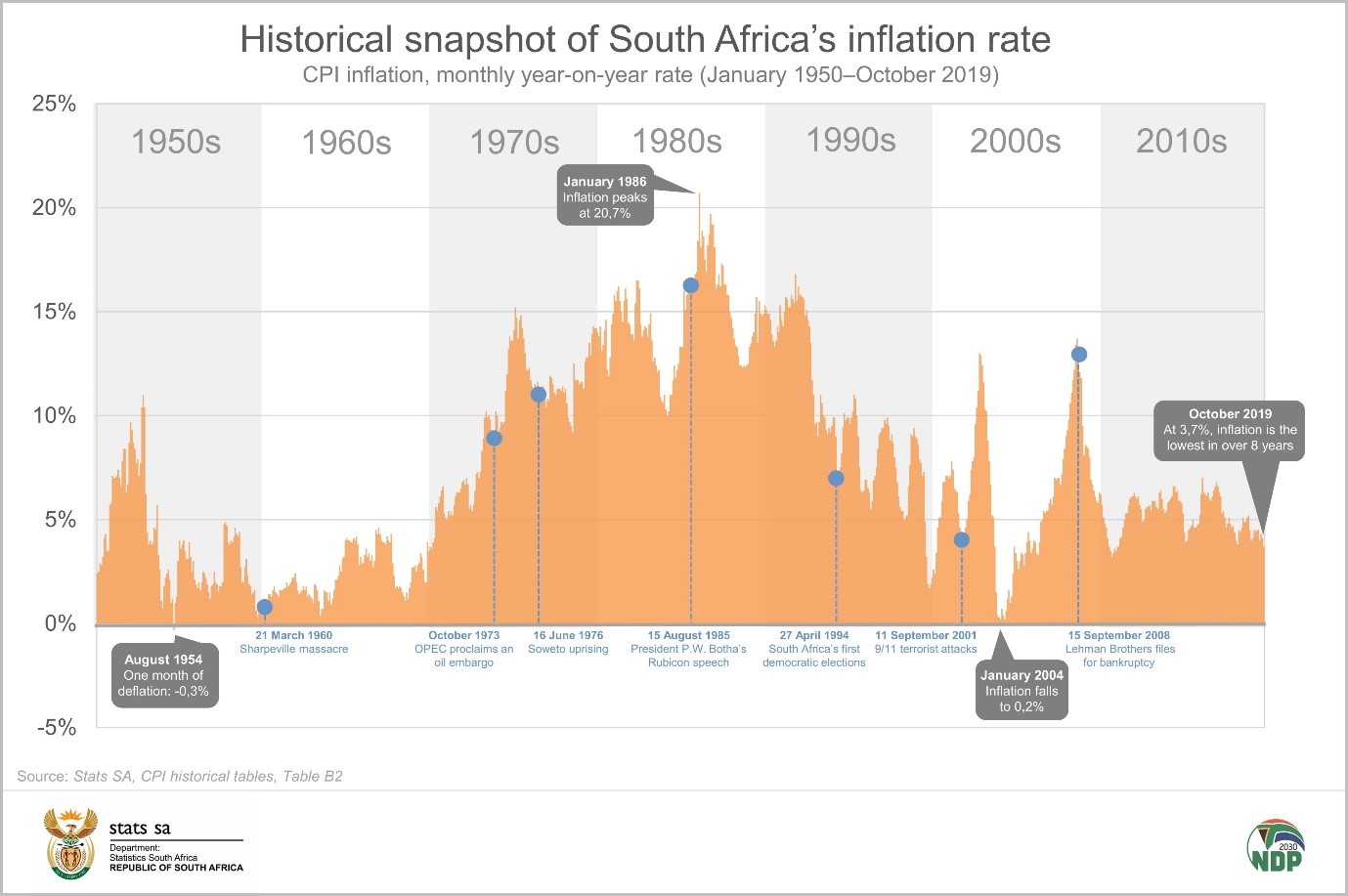

Inflation

Inflation (CPI) data surprised to the down side this morning with inflation numbers dropping to its lowest level in 8years. CPI came in lower at 3.7% from September’s 4.1% which is still within the South African Reserve Bank (SARB) 's target range of 3-6 percent.

Source - Stats SA

Source - Stats SA

Interest rates

The South African Reserve Bank (SARB) 's monetary policy committee (MPC) will only announce the interest rate decisions tomorrow at 15:00 SAST. It is widely expected that SARB will leave the benchmark rate unchanged. There is a 33% chance that we might see a 25-basis point rate cut when looking at the forward rate agreements.

According to the Bloomberg survey, 12 out of the 14 economists surveyed expect the Repo rate to remain unchanged at 6.5%.

ALSI

By looking at the broader market, we can see that the price action on the ALSI has finally broken out of the triangle price pattern. If the 50-day SMA holds up as support, then we might expect the price action to trend higher to the 52000-resistance level.

Source – Bloomberg

Source – Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.