The JSE found some reprieve on Wednesday as it managed to close the day firmer following consecutive sessions of relatively big losses.

Local equities were buoyed by a positive close in US equities overnight, as well as a firmer Rand locally which supported financial and retail stocks. The JSE did open weaker this morning but it managed to gain enough momentum during the day to end the day in the green.

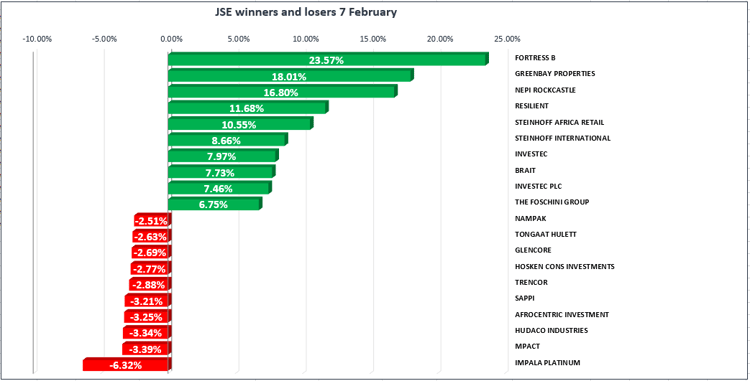

Gains were led by listed property stocks which have been trading under significant pressure for the past month. Fortress B [JSE:FFB], NEPI Rockcastle [JSE:NRP] and Resilient [JSE:RES] recorded gains of 23.57%, 16.80% and 11.68% respectively. Steinhoff [JSE:SNH] ended the day among the biggest gainers as it added 8.66% to close at R6.65 per share. Brait [JSE:BAT] climbed 7.73% whilst Discovery [JSE:DSY] and Nedbank [JSE:NED] gained 3.54% and 5.87% respectively. Retailers Shoprite [JSE:SHP] and Woolworths [JSE:WHL] firmed by 2.40% and 1.04% respectively.

Despite opening firmer Naspers [JSE:NPN] reversed all the gains to end the day 1.91% lower at R3066.09 per share. Rand hedge stocks traded under pressure due to the firmer Rand which saw stocks such as Richemont [JSE:CFR], British American Tobacco [JSE:BTI] and Mondi PLC [JSE:MNP] shedding 1.76%, 0.17% and 0.50% respectively. Gold mining shares retreated due to softer Gold prices, and as a result Gold Fields [JSE:GFI] and AngloGold Ashanti [JSE:ANG] traded 2.24% and 0.88% weaker.

The JSE All-Share Index ended the day 0.90% firmer whilst the JSE Top-40 Index inched up 0.65%. The Resources Index was the only index to end the day lower as it lost 1.42%. The Financials Index and Industrials Index gained 0.13% and 0.23% respectively.

The Rand firmed overnight on the back of rumours about President Jacob Zuma’s potential resignation. The Rand firmed intra-day to a high of R11.87 against the greenback, however it did ease to trade at R11.93/$ at 17.00 CAT.

The flight to safety seems to have subsided for now as Gold eased overnight to trade well below $1330/Oz. It traded mostly flat on Wednesday and it was recorded at $1324.66/Oz just after the JSE closed. The weakness in Gold has also been driven by strength in the US dollar as some investors look to liquidate their positions due to the current volatility in US equity markets.

Palladium took a big knock and broke below $1000/Oz to reach an intra-day low of $987.38/Oz. It was trading at $988.15/Oz just after the JSE close. Platinum also traded softer to be recorded at $985.11/Oz just after the JSE close.

Brent Crude was firmer ahead of US Crude Oil Inventories data release. At 5pm the commodity was 0.82% firmer at $67.50 per barrel.

US equity markets opened softer on Wednesday but the Dow Jones eventually turned positive to trade 0.4% firmer at 17.00 CAT, whilst the S&P500 and the Nasdaq were flat.