Global stocks including those on the JSE advanced on Monday following a week of extended declines which was induced by fears over the spread of the coronavirus.

The all-share index surged by more than 3% in earlier trading before relinquishing half of those gains as the session progressed. The reversal of gains was mainly triggered by the trend in US equity futures which pared earlier gains before swinging between and gains prior to the US spot market open. Major Asian indices advanced on Monday led by gains on the Shanghai Composite Index which gained 3.29%, while the Hang Seng and Nikkei added 0.62% and 0.95% respectively. In Europe, the major benchmarks traded moderately softer except for the FTSE 100 which advanced on the day.

The optimism was on the back of positive economic stimulus comments by officials from some of the world’s largest central banks. The US Fed hinted that it is open to rate cuts depending on the risks posed by the virus outbreak. Similar sentiments were also echoed by officials from Japan and the United Kingdom, thereby spurring the firmer open in trading to the week.

The rand which slipped last week along with other emerging market currencies found some momentum on Monday as it peaked at a session high of R15.45/$. At 17.00 CAT, the rand was trading 0.09% firmer at R15.64/$.

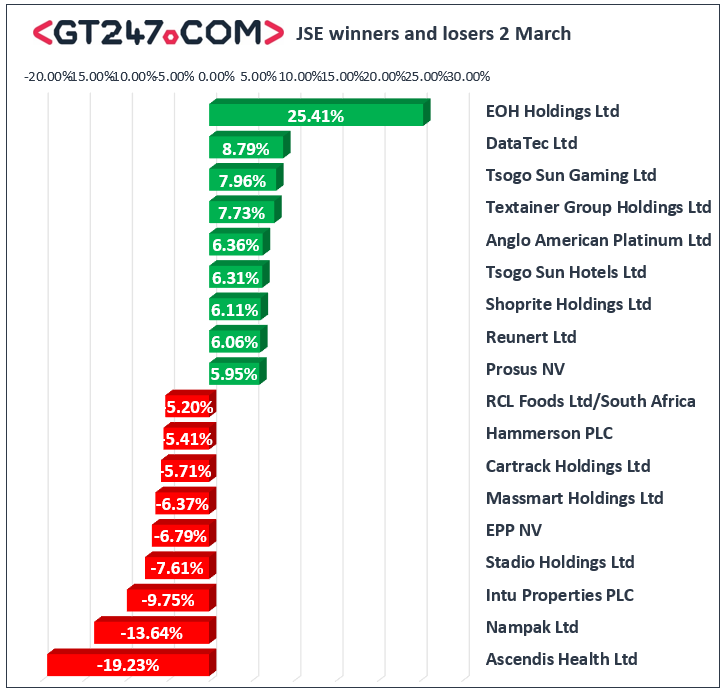

On the local bourse, South32 [JSE:S32] rallied 8.59% to close at R22.75, while diversified mining giant Anglo American PLC [JSE:AGL] gained 3.37% to close at R365.27. Shoprite [JSE:SHP] had another volatile session before the stock settled 6.11% higher at R118.97. Kumba Iron Ore [JSE:KIO] added 5.8% as it closed at R296.94, Gold Fields [JSE:GFI] rose 3.57% to close at R95.51, while Anglo American Platinum [JSE:AMS] closed at R1094.71 after gaining 4.52%. Significant gains were also recorded for Sappi [JSE:SAP] which firmed 5.38% to close at R30.75, as well as Prosus [JSE:PRX] which climbed 5.95% to close at R1117.50.

Packaging specialist, Nampak [JSE:NPK] plummeted 13.64% to close at R2.85, while Stadio Holdings [JSE:SDO] fell 7.61% to close at R1.70. Intu Properties [JSE:ITU] led the losses amongst the listed property stocks plunged 9.75% to close at R2.13, while weakness was also recorded for MAS Real Estate [JSE:MSP] which lost 4.04% to close at R15.91 following the release of its half-year results, as well as Hyprop Investments [JSE:HYP] which lost 1.79% to close at R43.83. Losses were recorded for Massmart [JSE:MSM] which fell 6.37% to close at R41.90, Investec Ltd [JSE:INL] which fell 1.86% to close at R77.40, and Reinet Investments [JSE:RNI] which closed at R317.14 after losing 1.62%.

The JSE All-Share index eventually closed 1.65% higher, while the blue-chip JSE Top-40 index gained 1.76%. The Resources index surged 2.46%, while the Industrials and Financials indices gained 1.9% and 0.23% respectively.

Brent crude managed to rise from its Friday lows as it was recorded trading 1.63% higher at $50.47/barrel just after the JSE close.

At 17.00 CAT, Palladium was down 1.59% to trade at $2251.94/Oz, Gold was 1.04% firmer at $1601.20/Oz, while Platinum was up 0.21% to trade at $865.63/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.