The local bourse closed softer on Thursday after another whipsaw session where stocks struggled to shrug off the negative sentiment.

Local market participants were focused on the interest rate decision from the SARB which was announced this afternoon, in which the MPC unanimously decided to cut rates by 100 basis points to 5.25%. To a large extent, a cut of this magnitude was expected given the bigger cuts that other major central banks have undertaken.

The rand came under pressure as the US dollar extended its gains against both developed and emerging market currencies. There was very limited reaction in the rand to the interest rate cut as it was already trading softer. At 17.00 CAT, the rand was trading 1.83% weaker at R17.39/$.

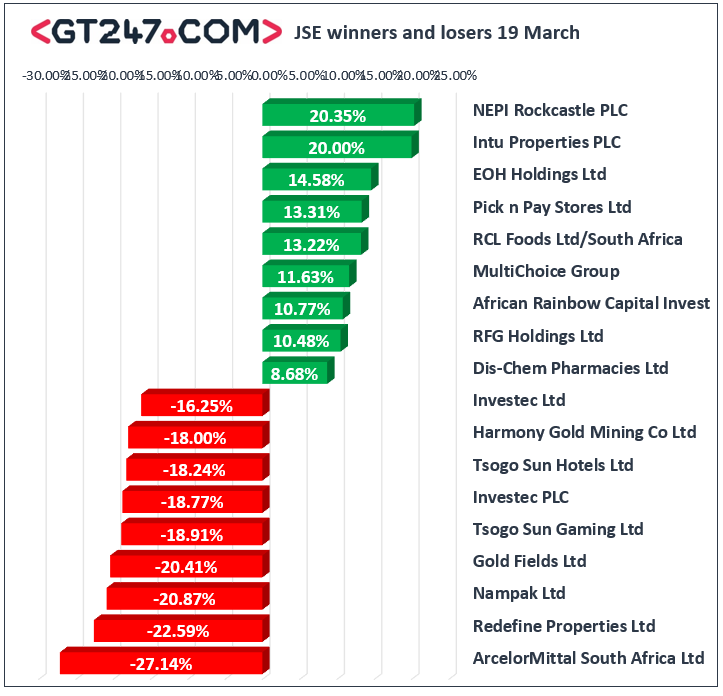

On the JSE, Redefine Properties [JSE:RDF] came under considerable pressure as it tumbled 22.59% to close at R2.09, Investec Property Fund [JSE:IAP] fell 10.71% to close at R7.00. The weaker rand saw bigger losses being recorded for retailers such as The Foschini Group [JSE:TFG] which lost 16.16% to close at R74.20, as well as Mr Price [JSE:MRP] which fell 13.67% to end the day at R103.74. Financials also struggled on the day with losses being recorded for Investec Ltd [JSE:INL] which closed 16.25% lower at R27.11, and for ABSA Group [JSE:ABG] which plummeted 15.54% to close at R79.83. ArcerlorMittal [JSE:ACL] closed amongst the day’s biggest losers after it fell 27.14% to close at R0.51, while Nampak [JSE:NPK] slipped 20.87% to close at R1.82. Capitec Bank Holdings [JSE:CPI] slipped further in today’s session as it reached a session low of R539.86 before it closed 14.69% lower at R682.50.

NEPI Rockcastle [JSE:NRP] had a change in fortunes in today’s session as it rocketed 20.35% to close at R65.65, while Intu Properties [JSE:ITU] surged 20% to end the day at R0.90. EOH Holdings [JSE:EOH] climbed 14.58% to close at R2.75 while African Rainbow Minerals [JSE:ARI] surged 10.77% to close at R2.16. Multichoice Group [JSE:MCG] managed to climb 11.63% to close at R88.77, while index giant Naspers [JSE:NPN] closed at R2049.29 after rising 6.69%. Significant gains were also recorded for Vodacom [JSE:VOD] which added 5.41% to close at R117.00, while Dis-Chem [JSE:DCP] rallied 8.68% to close at R23.29.

The broader JSE All-Share index closed 1.66% weaker while the JSE Top-40 index lost 1.37%. The Financials index tumbled 7.07%, while the Industrials and Resources indices lost 2.05% and 4.7% respectively.

Brent crude was also resurgent as it advanced in today’s session. It was recorded trading 6.03% higher at $26.38/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.74% weaker at $1475.17/Oz, Platinum was down 5.48% at $590.55/Oz, while Palladium was up 4.09% at $1666.29/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.