The JSE fell on Thursday as losses mounted amongst global markets on the back of the uncertainty surrounding a trade deal between the USA and China.

Global stocks remained skittish over the possibility of a trade deal happening due to conflicting news headlines about the progression of the talks. Equity indices in Asia closed weaker in earlier trading, while in Europe stocks pointed mostly lower. US Equity indices opened lower as well led by disappointment in retail giant, Macy’s earnings.

Locally, the South African Reserve Bank decided to keep the repo rate unchanged at 6.50% as the bank reiterated that future policy decisions would continue to be data driven. The rand held on to earlier gains and advanced further post the decision to peak at a session high of R14.64, before it was recorded trading 0.66% firmer at R14.67/$.

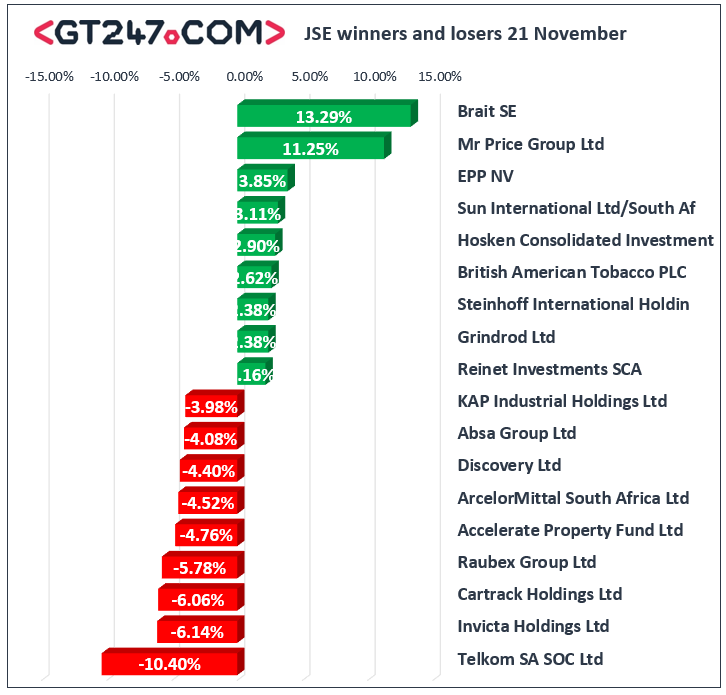

On the JSE, pressure mounted on Telkom [JSE:TKG] as it plummeted 10.4% to close at R46.35. Significant volume exchanged hands for Cartrack [JSE:CTK] as it lost 6.06% to close at R24.01, while construction firm, Raubex [JSE:RBX] fell 5.78% to close at R21.34. Bankers came under pressure despite the rand trading mostly firmer. Losses were recorded for ABSA Group [JSE:ABG] which lost 4.08% to close at R158.53, while Nedbank [JSE:NED] dropped 2.58% to end the day at R236.79. Imperial Logistics [JSE:IPL] also struggled as it lost 3.53% to close at R55.19, while African Rainbow Minerals [JSE:ARI] fell 3.24% to end the day at R156.27. Significant losses were also recorded for Discovery Ltd [JSE:DSY] which lost 4.4% to close at R128.75, Exxaro Resources [JSE:EXX] which fell 2.87% to R130.09, and Investec Ltd [JSE:INL] which lost 1.4% to close at R83.13 on the back of its half-year results.

Mr Price [JSE:MRP] led the day’s gains following the release of its half-year results. The stock rallied 11.25% to close at R183.51. Brait [JSE:BAT] also recorded substantial gains as it rocketed 13.29% to close at R15.86. Hospitality group, Sun International [JSE:SUI] rose 3.11% to close at R39.10, while industry peer Tsogo Sun Gaming [JSE:TSG] found momentum following the release of its half-year results as it closed 0.81% firmer at R12.38. Rand hedge, British American Tobacco [JSE:BTI] advanced 2.62% to end the day at R560.53, while Reinet Investments [JSE:RNI] gained 2.16% to close at R301.00. Gains were also recorded for Mediclinic [JSE:MEI] which added 1.27% to close at R75.95, as well as Astral Foods [JSE:ARL] which rose 1.9% to R191.57.

The JSE All-Share Index eventually closed 1.35% weaker while the JSE Top-40 index lost 1.44%. All the major indices recorded declines on the day with the biggest loss being recorded for the Resources index which lost 2.15%. The Industrials and Financials indices lost 0.7% and 1.91% respectively.

Brent crude advanced on the news that OPEC is prepared to extend its production cuts. The commodity was trading 1.04% firmer at $63.08/barrel just after the JSE close.

At 17.00 CAT, Platinum was up 0.63% to trade at $922.75/Oz, Palladium had shed 0.13% to trade at $1764.10/Oz, and Gold was down 0.25% at $1467.50/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.