The JSE closed weaker on Wednesday as retailers and Naspers dragged the local index lower.

Most of the big name retailers were trading ex-dividend on Wednesday and as a result they traded softer from their overnight close. Naspers [JSE:NPN] also traded under pressure after its Hang Seng listed associate, Tencent Holdings barely managed to close in the green in a session where it mostly traded under pressure. Naspers closed 1.2% weaker at R3538.00 per share.

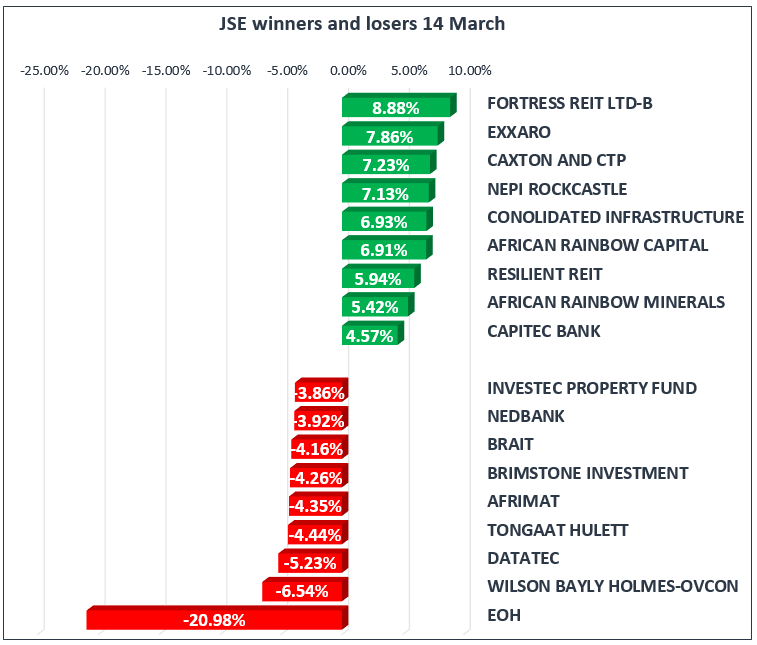

EOH Holdings [JSE:EOH] came under pressure following the release of a trading statement which indicated that they are expecting significant decreases in earnings for the 6 months ended 31 January 2018. The stock lost 20.98% to close at R59.50 per share. WBHO [JSE:WBO] and Brait [JSE:BAT] also traded under significant pressure as they lost 6.54% and 4.16% respectively, whilst Clicks [JSE:CLS] shed 3.61%.

Truworths [JSE:TRU], Massmart [JSE:MSM] and Woolworths [JSE:WHL] who were all trading ex-dividend, shed 3.82%, 3.79% and 3.19% respectively. Pioneer Foods [JSE:PNR] and Famous Brands [JSE:FBR] traded softer as they lost 3.83% and 3.07% respectively, whilst banking socks Nedbank [JSE:NED] and Standard Bank [JSE:SBK] were 3.92% and 2.27% weaker respectively.

Miners Exxaro [JSE:EXX] and Kumba Iron Ore tracked higher today as they gained 7.86% and 2.12% respectively, whilst Capitec Bank [JSE:CPI] bucked the trend in the other banking shares to end the day up 4.57%. Listed property stocks Fortress B [JSE:FFB], NEPI Rockcastle [JSE:NRP] and Resilient [JSE:RES] recorded a second consecutive session of gains as they added 8.88%, 7.13% and 5.94% respectively. Consolidated Infrastructure also ended amongst the day’s biggest gainers after it closed up 6.93%.

The JSE All-Share Index eventually ended the day 1.17% weaker, whilst the blue-chip Top-40 Index lost 1.15%. All the major indices ended weaker with the biggest loser being the Financials Index which lost 1.52%. The Industrials Index and the Resources Index lost 1.41% and 0.20% respectively.

Brent Crude briefly traded above $65/barrel to reach a session high of $65.21/barrel. The commodity retraced back to trade flat before it gained momentum once again following the release of US Crude Oil Inventories data. Brent Crude was trading at $64.68/barrel just after the close.

The earlier upside in Gold quickly faded as the commodity traded mostly softer in today’s session. Despite peaking at a session high of $1330.11/Oz the metal retraced to trade 0.24% softer at $1324.16/Oz at 17.00 CAT.

Platinum traded firmer for the better potion of today’s session but it quickly erased all the gains towards the US equity markets open. The metal was trading at $963.90/Oz just after the close, this was after it retraced from a session high of $973.97/Oz. On the other hand Palladium regained its momentum to climb back above $1000/Oz as it reached a session high of $1006.60/Oz. The metal was trading 1.2% firmer at $1003.30/Oz just after the close.