The local bourse shrugged the trend in other global stocks as it closed firmer on Tuesday primarily on the back of gains in the resources sector.

With Chinese markets closed for a holiday, there was little sentiment filtering from that market. In Japan, the Nikkei eventually closed 0.59% firmer. Stocks in Europe were dragged lower by a flurry of weaker than expected manufacturing PMI from most of the bloc’s members. This reignited fear of a global slowing economy which was worsened by a reading of US manufacturing PMI data which printed its lowest level since the financial crisis of 2008.

There was bad news in terms of local economic data via the release of the ABSA Manufacturing PMI reading for September which fell to 41.6 from a prior recording of 45.7. This was also worse than the forecast of 43. The rand slumped further in today’s session as it fell to a session low of R15.35 before it was recorded trading 1.38% weaker at R15.34/$ at 17.00 CAT.

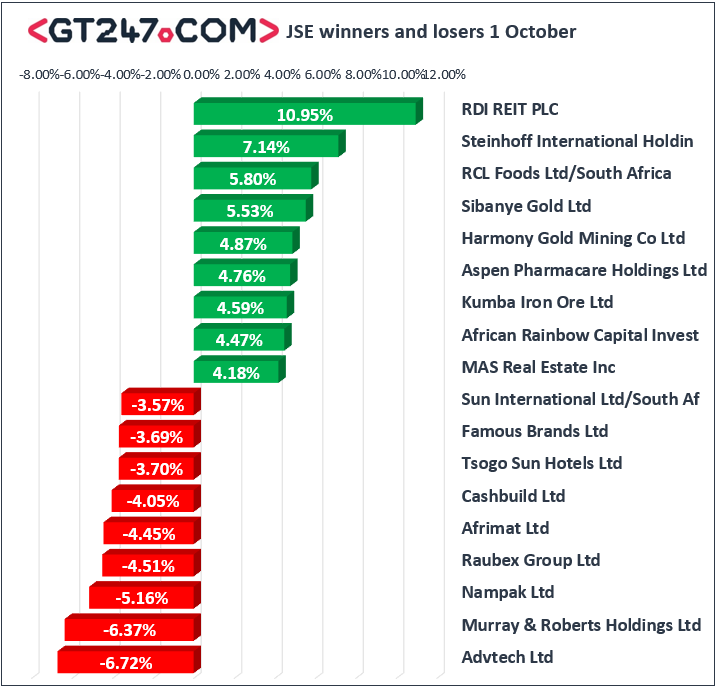

Murray & Roberts [JSE:MUR] closed amongst the day’s biggest losers after it lost 6.37% to close at R12.35 following the release of a statement announcing the lapsing of the mandatory offer by ATON to acquire all of its issued share capital. Sector peer, Raubex [JSE:RBX] also traded under significant pressure eventually closing 4.51% lower at R18.20. Retailers lost further ground on the back of the weaker rand. Massmart [JSE:MSM] fell 2.72% to close at R42.64, Shoprite [JSE:SHP] dropped 1.65% to close at R120.62, and Woolworths [JSE:WHL] lost 1.33% to end the day at R54.35. Commodity trading giant Glencore [JSE:GLN] lost 2.51% as it closed at R44.73, while food producer Famous Brands [JSE:FBR] lost 3.69% to close at R78.47.

RDI REIT [JSE:RPL] rallied significantly towards the close as it ended the day 10.95% higher at R23.00. However, most of the gains on the day were driven by miners. Although modest, index giant BHP Group [JSE:BHP] added 0.63% to close at R349.53. More significant gains were recorded for Sibanye Stillwater [JSE:SGL] which gained 5.53% to close at R22.14, Harmony Gold [JSE:HAR] which rallied 4.87% to end the day at R45.41, AngloGold Ashanti [JSE:ANG] which climbed 3.69% to R294.56. Sasol [JSE:SOL] found some traction as it gained 3.53% to close at R262.00, while coal miner Exxaro Resources [JSE:EXX] managed to gain 2.6% to close at R134.00. Kumba Iron Ore [JSE:KIO] surged 4.59% to close at R391.65, and African Rainbow Capital [JSE:AIL] closed at R4.44 after gaining 4.47%.

The JSE All-Share index eventually closed 0.26% firmer while the blue-chip JSE Top-40 index also managed to add 0.26%. The Resources index recorded significant gains of 1.11% while the Financials index was unchanged on the day. The Industrials index shed 0.11%.

At 17.00 CAT, Gold was 0.755 firmer at $1483.67/Oz, Platinum was down 0.37% at $879.90/Oz, and Palladium had lost 0.75% to trade at $1663.90/Oz.

Brent crude was marginally firmer as it was recorded trading 0.62% firmer at $59.63/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.