The JSE managed to close firmer on Friday despite earlier declines as it surged on the back of gains in the resources index.

The local bourse got off to a slow start as it retreated marginally in earlier trading before it found momentum towards the afternoon session. Trading in Asia was mixed earlier on as the Shanghai Composite Index fell 1.02%, while the Nikkei and Hang Seng in. Trading in Asia was mixed earlier on as the Shanghai Composite Index fell 1.02%, while the Nikkei and Hang Seng inched up 0.32% and 0.48% respectively. Stocks in Europe also tracked higher as there wasn’t much deviation to the trade talks headlines that were released in the prior session. The momentum in Europe held despite mostly lower thanched up 0.32% and 0.48% respectively. Stocks in Europe also tracked higher as there wasn’t much deviation to the trade talks headlines that were released in the prior session. The momentum in Europe held despite mostly lower than expected manufacturing and services PMI readings for most members of the bloc.

The rand strengthened against the greenback as it peaked at a session high of R14.59/$. However, the local unit relinquished most of these gains as it was recorded trading 0.04% firmer at R14.67/$ at 17.00 CAT.

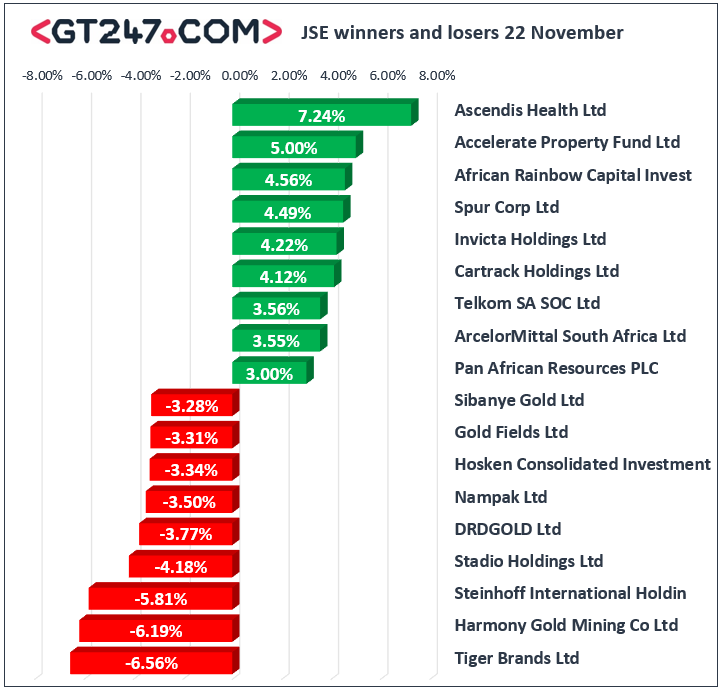

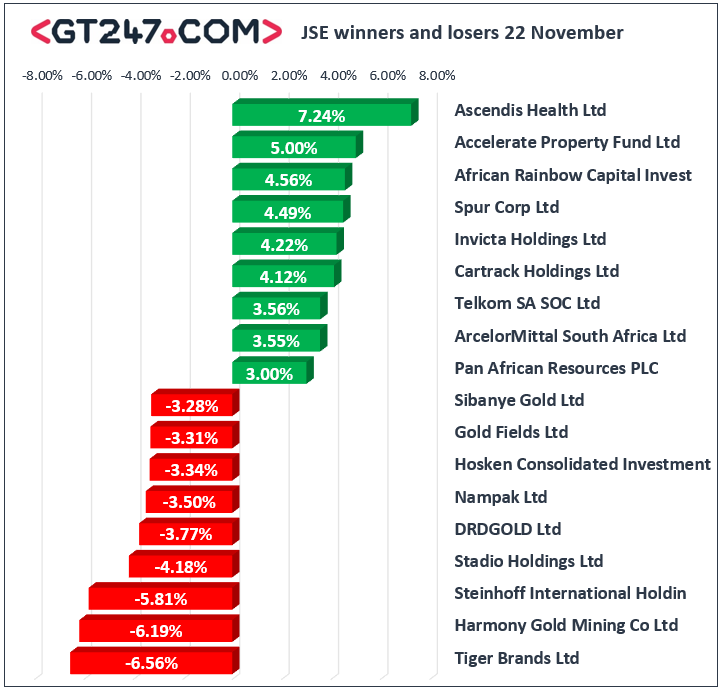

Index heavyweight Naspers [JSE:NPN] was buoyed by the release of its interim results which saw the stock gain 1.18% to close at R2233.15. Diversified mining giant Anglo American PLC [JSE:AGL] rose 2.46% as it closed at R389.08, while its sector peer BHP Group [JSE:BHP] advanced 2.24% to close at R322.56. Commodity trading giant Glencore [JSE:GLN] surged 2.61% to close at R46.86, while Kumba Iron Ore [JSE:KIO] added 1.85% to close at R381.93. Telkom [JSE:TKG] found some reprieve as it gained 3.56% to close at R48.00, while Brait [JSE:BAT] managed to add 1.58% as it closed at R16.11. Other significant gainers on the day included Exxaro Resources [JSE:EXX] which added 2.74% to close at R133.66, Mondi PLC [JSE:MNP] gained 1.41% to close at R316.11, and Sasol [JSE:SOL] which closed at R282.62 after rising 2.04%.

Tharisa PLC [JSE:THA] came under pressure following the release of its full-year trading statement which showed significant declines in earnings. The stock lost 21.91% to close at R15.22. Tiger Brands [JSE:TBS] reported lower headline earnings in its full-year results which saw the stock fall 6.56% to close at R216.99. Gold miners also struggled on the day as losses were recorded for Harmony Gold [JSE:HAR] which lost 6.19% to close at R46.97, while Gold Fields [JSE:GFI] dropped 3.31% to end the day at R77.68. Retailers came under pressure with declines being recorded for Massmart [JSE:MSM] which fell 2.07% to close at R44.01, Pick n Pay [JSE:PIK] which lost 1.5% to close at R68.78, and Mr Price [JSE:MRP] closed at R179.74 after losing 2.05%.

The JSE All-Share index eventually closed 0.14% firmer while the JSE Top-40 index added 0.5%. The Resources index recorded most of the day’s gains as it closed 1.49% higher. The Industrials and Financials indices lost 0.1% and 0.62% respectively.

At 17.00 CAT, Gold was 0.06% firmer at $1465.04/Oz, Palladium was 0.5% firmer at $1769.15/Oz, and Platinum had surged 1.81% to trade at $899.25/Oz.

Brent crude surged above $64/barrel in today’s session before it was recorded trading 0.14% firmer at $64.06/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.