The local bourse advanced to close firmer on Wednesday primarily on the back of positive sentiment currently engulfing global markets.

The JSE opened mildly firmer and climbed further as the session progressed. The surge started off in Asia where the Shanghai Composite Index gained 0.81%, the Hang Seng added 0.87% while the Nikkei rose 0.74%. In Europe, all the major equity benchmarks advanced on the day while US equity futures also traded in positive territory.

In terms of local economic data, South African retail sales numbers for the month of December came in worse than expected. Retail sales YoY was recorded at -0.4% from a prior recording 2.6%, while retail sales MoM was recorded at -3.1% from a prior recording of 2%. A volatile session ensued for the rand which peaked at a session high of R14.73/$, before it retraced to be recorded 0.21% weaker at R14.83/$ at 17.00 CAT.

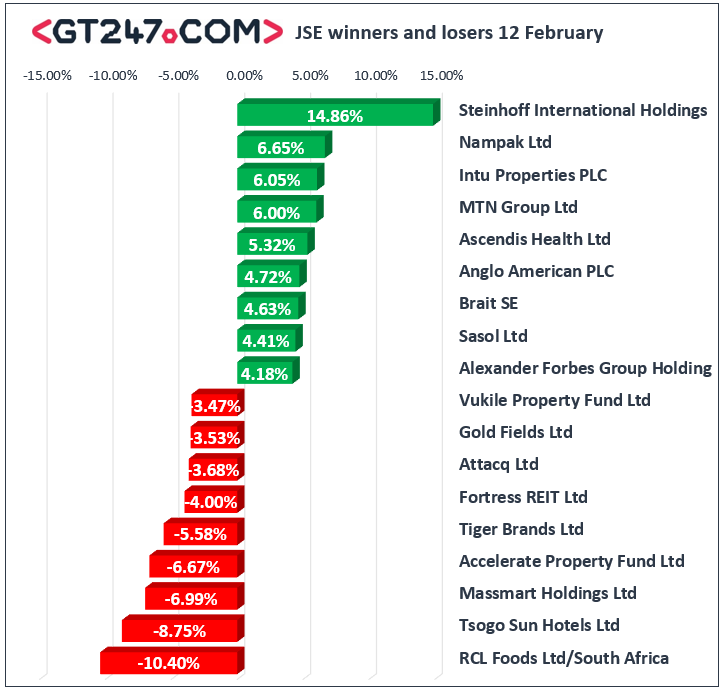

On the JSE, the resources index led most the day’s gains with advances being recorded for Anglo American PLC [JSE:AGL] which surged 4.72% to close at R413.04, while coal miner Exxaro Resources [JSE:EXX] gained 2.88% to close at R122.50. Harmony Gold [JSE:HAR] which announced the acquisition of two assets from AngloGold Ashanti, gained 3.66% to close at R43.33, while African Rainbow Minerals [JSE:ARI] added 2.21% to close at R158.04. Sasol [JSE:SOL] recorded another session of gains as it rallied 4.41% to close at R240.60, while Imperial Logistics [JSE:IPL] rose 3.23% to close at R51.07. MTN Group [JSE:MTN] which released a positive trading update on Tuesday after the close, advanced 6% to close at R88.10. Gains were also recorded for Vodacom [JSE:VOD] which closed at R3.79 after gaining 123.64%, as well as Old Mutual [JSE:OMU] which closed at R17.62 after gaining 2.86%.

Most of the retailers pulled back because of the weaker retail sales data. Massmart [JSE:MSM] came under considerable pressure as it fell 6.99% to close at R55.10, while Shoprite [JSE:SHP] lost 1.3% to close at R114.29. Tiger Brands [JSE:TBS] was dragged down by the release of weaker half-year trading update which saw the stock close 5.58% lower at R188.00. Weakness was also recorded for most of the gold miners with declines being recorded for Gold Fields [JSE:GFI] which lost 3.53% to close at R92.99, as well as DRD Gold [JSE:DRD] which lost 2.26% to close at R9.10 despite releasing its six months earnings results today. Losses were also recorded for Hyprop Investments [JSE:HYP] which lost 3.2% to close at R49.69, as well as Vukile Property Fund [JSE:VKE] which closed at R16.41 after retreating 3.47%.

The JSE Top-40 index eventually closed 1.67% higher while the broader JSE All-Share index gained 1.45%. All the major indices rallied on the day. Industrials gained 1.18%, Financials managed to gain 1.49% and the Resources index surged 2.22%.

At 17.00 CAT, Palladium was trading flat at $2340.42/Oz, Gold was down 0.22% at $1564.12/Oz, and Platinum had lost 1.03% to trade at $958.72/Oz.

Brent crude has also found its footing with the rebound in global stocks. The commodity was trading 3.72% higher at $56.01/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.