Local equities closed flat on Thursday as the South African Reserve Bank kept the repurchase rate unchanged at 6.75%.

The Rand strengthened even further after the rate announcement to reach an intra-day high of R12.15 against the US dollar. It retraced slightly to trade at R12.18/$ at 5pm.

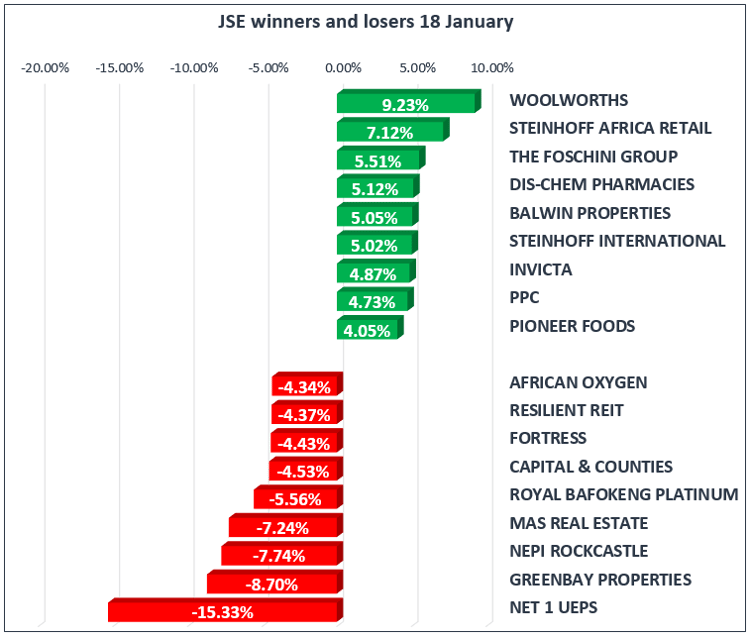

Retail stocks carried their momentum from Wednesday as they tracked even higher. The positive sentiment surrounding retail stocks is mainly attributed to the big jump in South African retail sales numbers released on Wednesday as well as the firmer Rand. Stocks such as Woolworths [JSE:WHL] which released a relatively disappointing sales update this week rallied even further, gaining 9.23% to close R66.63 per share. Retailers Shoprite [JSE:SHP], Truworths [JSE:TRU] and Massmart [JSE:MSM] gained 3.68%, 3.88% and 3.21% respectively.

Banking stocks also recorded gains with Nedbank [JSE:NED], Rand Merchant Investment Holdings [JSE:RMH] and Barclays Africa [JSE:BGA] gaining 2.42%, 3.33% and 2.56% respectively. Other notable moves higher were Barloworld [JSE:BAW] which firmed by 3.82%, as well as Vodacom [JSE:VOD] which climbed 3.02%. PPC Limited [JSE:PPC] and Dis-Chem [JSE:DCP] recorded gains of 4.73% and 5.12% respectively.

Property stocks took a knock in today’s session with the biggest casualties being NEPI Rockcastle [JSE:NRP] and Greenbay Properties [JSE:GRP] which lost 7.10% and 8.70% respectively. Fortress B [JSE:FFB] lost 4.43% whilst Delta Properties [JSE:DLT] shed 2.87%.

Brait [JSE:BAT] continued to trade under pressure as it shed another 4.08% to close at R36.45 per share. Aspen [JSE:APN] lost 1.03% whilst miners Impala Platinum [JSE:IMP] and Northam Platinum shed 1.30% and 3.39% respectively mainly on the back of weaker Platinum prices. Index heavyweight Naspers [JSE:NPN] lost 0.98% to close at R3665.11 per share.

The JSE Top-40 Index eventually closed up 0.06% whilst the JSE All-Share Index gained 0.14%. The Industrials Index closed flat as it inched up 0.03% whilst the Financials Index jumped on the back of the firmer Rand to close up 1.26%. The Resources Index shed 0.82%.

Gold traded weaker for the better portion of today’s session but it started to gain momentum towards the JSE close as the US dollar traded softer. The precious metal had slid earlier on to a low of $1324.33/Oz before it managed to rebound. Gold was trading at $1331.90/Oz just after the JSE close.

Palladium lost its earlier momentum to retrace from an intra-day high of $1120.84/Oz. It was trading at $1105.95/Oz just after the JSE close. Platinum was also caught in a similar volatile trading action as it slid to a low of $996.56./Oz earlier on, before retracing to trade at $1006.11/Oz just after the JSE close.

Brent Crude was trading mostly flat as it failed to gain any significant direction. It was trading at $68.86 per barrel just after the JSE close, with Crude Oil Inventories data out of the USA due at 6pm CAT.