A volatile trading session ensued for the JSE on Tuesday as it swung between being flat and gains before eventually closing firmer.

The local bourse opened firmer as it tried to follow trends in other global markets which also attempted to rebound. High volatility was the order of the day as major equity bourses all whipsawed between gains and paring gains. With central banks such as the US Fed taking advanced measures to mitigate the impact of the virus to the economy, investors are still dumping riskier assets as fears grow daily.

The rand found some momentum in today’s session as it peaked at a session high of R16.42/$. The local unit retreated in the afternoon session however it was recorded trading 0.26% firmer at R16.64/$ at 17.00 CAT. Local investors are closely watching for the SARB’s reaction to the coronavirus threat as the Monetary Policy Committee (MPC) is expected to announce its interest rate decision on Thursday.

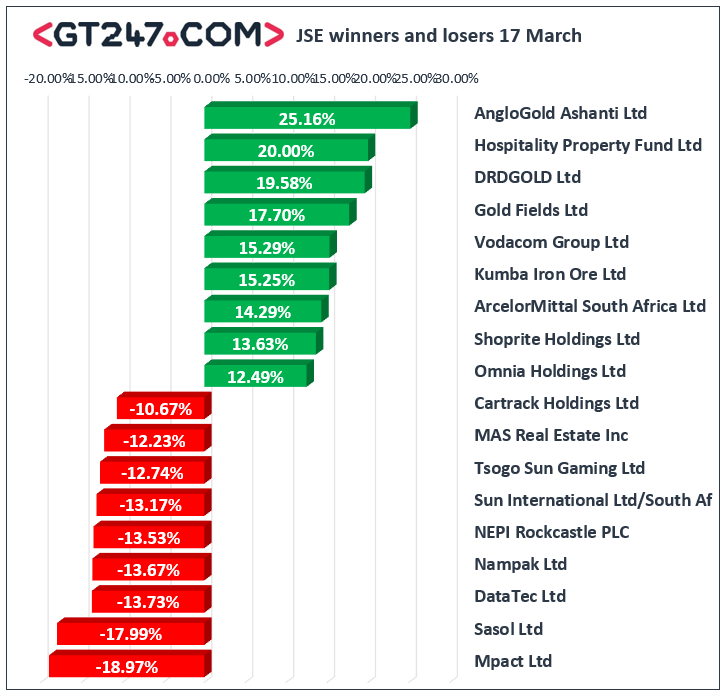

On the JSE, a strong rebound in metal commodity prices saw the resources index lead the day’s gains. AngloGold Ashanti [JSE:ANG] surged 25.16% as it closed at R303.61, Gold Fields [JSE:GFI] gained 17.7% to close at R87.37, while Harmony Gold [JSE:HAR] rallied 12.15% to close at R44.96. Telecoms provider, Vodacom [JSE:VOD] rocketed 15.29% to close at R114.30, while television content provider Multichoice [JSE:MCG] gained 7.01% to close at R80.33. Gains were for retailer Shoprite Holdings [JSE:SHP] which rose 13.63% to close at R117.13, as well as Woolworths [JSE:WHL] which gained 8.25% to close at R31.49. Diversified mining giant BHP Group [JSE:BHP] jumped 8.67% to close at R225.79, while Sibanye Stillwater [JSE:SSW] added 5.39% to end the day at R22.29. Gains were also recorded for Aspen Pharmacare [JSE:APN] which advanced 7.34% to close at R94.53, as well as Richemont [JSE:CFR] which closed at R88.31 after gaining 4.89%.

Despite opening more than 10% higher following the release of a statement early on Tuesday morning, Sasol [JSE:SOL] erased all the earlier gains to end the day 17.99% lower at R36.69. Nampak [JSE:NPK] erased most of the gains from the prior session as it tumbled 13.67% to close at R2.40, while Tsogo Sun Gaming [JSE:TSG] lost 12.74% to close at R5.55. Listed property stocks could not catch a reprieve as declines were recorded for NEPI Rockcastle [JSE:NRP] which fell 13.53% to close at R78.72, Emira Property Fund [JSE:EMI] which slipped 6.68% to close at R7.68, as well as Vukile Property Fund [JSE:VKE] which closed at R8.84 after losing 8.2%.

The JSE Top-40 index eventually closed 2.96% firmer while the JSE All-Share index gained 2.67%. The Financials index remained subdued as it lost another 1.57%, however gains were recorded for the Resources and Industrials indices which advanced 6.33% and 2.68% respectively.

Brent crude remained under pressure as news filtered that Saudi Arabia would export a record number of 10 million barrels a day. The commodity was trading 1.3% softer at $29.66/barrel just after the JSE close.

At 17.00 CAT, Gold was up 1.34% at $1534.99/Oz, Palladium had risen 6.23% to trade at $1707.80/Oz, while Platinum was 4.54% firmer at $695.97/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.