The JSE retreated on Wednesday despite a broad-based rebound across the major global markets on the back of positive news from Chinese officials.

China indicated that it is open to a limited deal with the USA provided no additional tariffs are imposed on it at the next high-level talks which are set to resume on Thursday. With the revived hopes of a positive outcome in these upcoming trade talks, European and US stocks rebounded to trade firmer on the day. However, the JSE took a leaf from Asian markets which closed weaker with losses being recorded for the Nikkei and the Hang Seng, while the Shanghai Composite Index only managed to gain 0.14%.

The rand strengthened against the greenback as emerging market currencies staged a minor rebound. At 17.00 CAT, the rand was trading 0.52% firmer at R15.20/$.

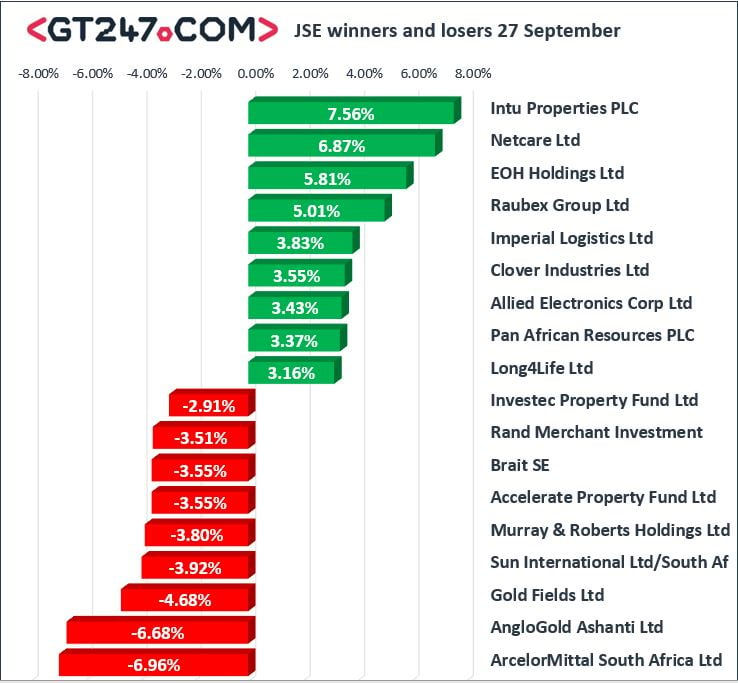

On the JSE, losses were led by coal miner Exxaro Resources [JSE:EXX] which was trading ex-dividend as it lost 12.79% to close at R120.03. EOH Holdings [JSE:EOH] stumbled further in today’s session as it lost 6.66% to end the day at R12.47. Some of the listed property stocks came under pressure with losses being recorded for Hyprop Investments [JSE:HYP] which lost 5.92% to close at R58.00, NEPI Rockcastle [JSE:NRP] dropped 2.355 to close at R131.40, while MAS Real Estate [JSE:MSP] fell 4.72% to close at R17.15. Retailer, Truworths [JSE:TRU] fell 5.32% to close at R50.33, while its sector peer The Foschini Group [JSE:TFG] stumbled 3.64% to close at R157.39. Losses were also recorded for Sappi [JSE:SAP] which lost 3.33% to close at R37.49, Bid Corporation [JSE:BID] which lost 1.12% to R337.00, and BHP Group [JSE:BHP] which closed at R309.30 after falling 1.09%.

Gains were once again limited mostly to miners. Pan African Resources [JSE:PAN] surged 5.07% as it closed at R2.28, Sibanye Gold [JSE:SGL] gained 3.54% to end the day at R25.18, while Kumba Iron Ore [JSE:KIO] climbed to R380.32 after rising 2.81%. AngloGold Ashanti [JSE:ANG] gained 2.83% as it closed at R324.49, Gold Fields [JSE:GFI] climbed 2.41% to R85.86, and Northam Platinum [JSE:NHM] added 2.34% to R95.79. Other significant gainers on the day included Bidvest Group [JSE:BVT] which rose 1.13% to R193.13, and Anglo American PLC [JSE:AGL] which gained 0.92% to close at R342.31.

The JSE All-Share index eventually closed 0.35% while the JSE Top-40 index shed 0.32%. The Resources index only gained a modest 0.11%, while the Industrials and Financials indices lost 0.64% and 0.31% respectively.

Brent crude also rose on the hopes of renewed trade talks which saw it trading 0.5% firmer at $58.53/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 0.2% to trade at $888.10/Oz, Gold was up 0.1% at $1507.08/Oz, and Palladium had firmed 0.59% to trade at $1684.80/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.