The JSE closed softer on Thursday as financials retreated on the back of a weaker rand.

The move in the rand was indirectly a result of the euro weakening ahead of the European Central Bank’s interest rate decision and press conference which took place on Thursday afternoon. The ECB left the main refinancing rate unchanged at 0.00%, however with the weak economic data that has been recorded from most major European economic powerhouses over the past month the central was expected to take a more dovish stance on monetary policy.

The euro which has been on the backfoot against major currencies this week, fell to a two-year low as the ECB president signaled that future interest rate cuts were in the pipeline despite holding back for now. The US dollar advanced as a result, which saw most emerging market currencies track lower against the greenback. The rand was not spared as it tumbled to a session low of R14.08/$ before it was recorded trading 1.17% weaker at R14.03/$ at 17.00 CAT.

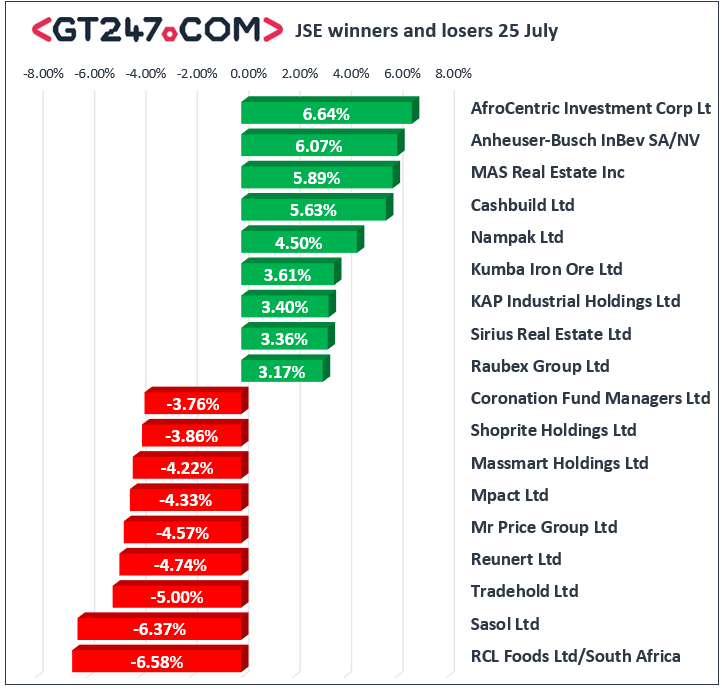

The JSE opened softer and continued to trade weaker for the entirety of today’s session. Oil and gas producer Sasol [JSE:SOL] fell following the release of trading statement in which it indicated that it is expecting lower earnings per share for its full financial year. The company also flagged the increase in the capital cost of the Lake Charles Chemical Project as significant impairment to its profitability. The stock eventually closed at R308.00 after falling 6.37%.

Rand sensitive stocks also retreated as the rand weakened. Retailer Mr Price [JSE:MRP] dropped 4.57% to close at R185.90, Massmart [JSE:MSM] lost 4.22% to end the day at R60.58, and Shoprite [JSE:SHP] fell 3.86% to close at R148.05. Coronation Fund Managers [JSE:CML] weakened by 3.76% to close at R42.98 following the release of its assets under management statement. The banks also traded softer with losses being recorded for Standard Bank [JSE:SBK] which dropped 3.02% to close at R184.25, as well as ABSA Group [JSE:ABG] which lost 1.41% to end the day at R166.57.

Anheuser-Busch InBev [JSE:ANH] advanced on the day mainly on the back of the release of its positive half-year results. The stock managed to gain 6.07% as it closed at R1416.07. Kumba Iron Ore [JSE:KIO] also found some traction as it gained 3.61% to close at R477.73, while South32 [JSE:S32] rose to close at R30.71 after adding 2.2%. Harmony Gold [JSE:HAR] was buoyed by the release of its operational update which indicated that the company is in line with its initial guidance. The miner advanced 2.37% to close at R35.38, while Sibanye Stillwater [JSE:SGL] gained 1.92% to close at R18.54.

The JSE Top-40 index eventually closed 0.12% weaker while the JSE All-Share index shed 0.3%. The Financials was the biggest loser amongst the major indices as it fell 1.26%. The Industrials and Resources indices dropped 0.16% and 0.03% respectively.

After tumbling overnight, brent crude resurged in today’s session and it was eventually recorded trading 1.01% higher at $63.82/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 0.68% to trade at $870.95/Oz, Palladium was 0.12% weaker at $1543.10/Oz, and Gold had shed 0.48% to trade at $1418.80/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.