Equity market closed the week in the black after a week of key economic releases that were merely ignored by the market. The dominant themes this week were that of Quality easing and interest rate cuts. Its has now become clear that Donald Trump has arm twisted the hand of the FED as many Governors believe that given the current conditions in the market there is no room for rate hikes.

The US economy currently faces a low interest and low inflation regime, the Trump regime would like to see interest lower to boost economic growth. The RBA managed to cut interest rates by 25basis points this week, however the ECB failed to move on interest rates, sighting the current Sin-US trade war as the major hurdle for any interest rate cut or hike. The monthly non-farm payroll numbers released on Friday missed market expectations, however equity markets continued to rally as this solidified market expectations of an interest rate cut.

The existing commodity market dichotomy stills has the market anticipating what the next moves will be in the commodity market. Market fundamentals point to a much higher oil price, with the current trade embargos on Iran and Venezuela’s limiting oil output in these key oil exporting nations. Moves in precious metals have followed market expectations higher.

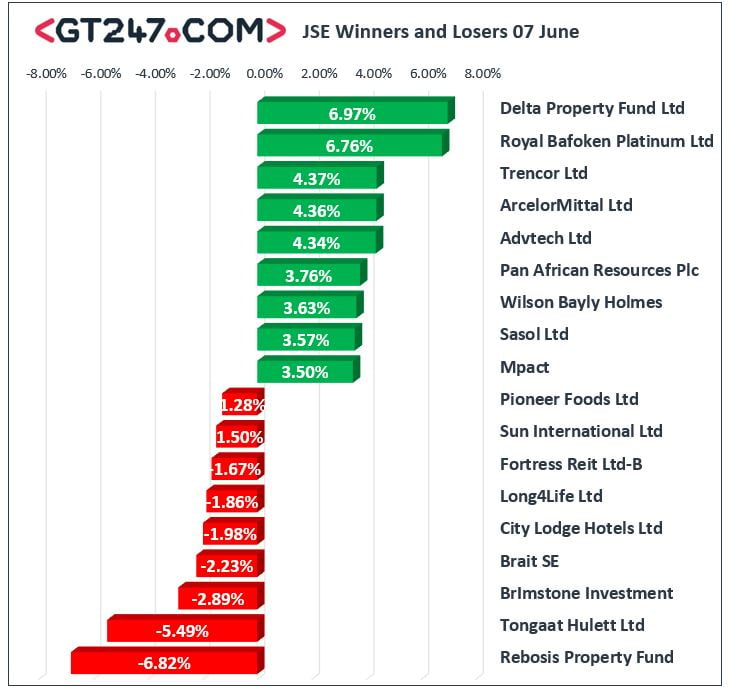

Significant gains were made by Delta Property Fund Ltd [JSE:DLT] which gained 6.97% on the day to trade at 215c, Platinum miner Royal Bafokeng Ltd [JSE:RBP] had a sterling day adding 6.76%. Gains were also recorded by Sasol Ltd [JSE:SOL], Pan African Resources [JSE:PAN] and Advtech Ltd, which gained 3.57%, 3.76% and 4.34% respectively.

The worst performing shares on the day were Rebosis Ltd [JSE:REB], which eased 6.82% to trade at 82c at the close of business. Tongaat Hulett Ltd [JSE:TON], continues to come under pressure and shed 5.49% on the day to trade at 1395c.

The JSE All-Share index advanced 1.94%, whilst the JSE Top-40 index gained 2.14%. The Resource index rallied 2.31%, the Industrials were firmer adding 2.14% whilst the Financials gained 1.74%.

At 17.00 CAT, Palladium was 1.21% firmer to trade at $1365/Oz, Platinum was also firmer adding 0.45% to trade at $807.10/Oz. Gold bulls have had a good week as the yellow metal rallied 0.49% to trade at $1349.25 at 17:00hrs CAT.

Brent crude was firmer on the day to trade at $62.55 having posted a session low of $61.77/ barrel.

The local unit recovered some lost ground in afternoon trade breaching R15.00 per $ level. At 17:00 CAT the Rand was trading at R14.91 against the USD, R16.90 to the Euro and R19.01 to the Pound Sterling.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.