The JSE reversed earlier losses to close the day firmer after the delivery of the medium-term budget speech by Finance minister, Malusi Gigaba.

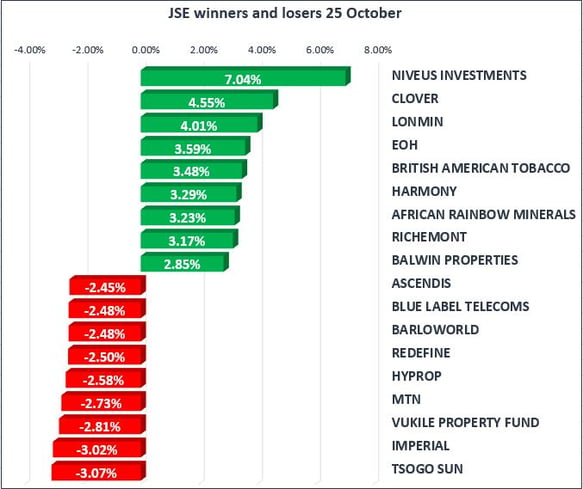

This reversal on the JSE was driven by the weaker Rand which resulted in Rand hedge stocks firming. British American Tobacco [JSE:BTI], Richemont [JSE:CFR] and Reinet [JSE:REI] ended the day amongst the biggest blue chip index gainers as they firmed by 3.48%, 3.17% and 2.78% respectively.

EOH Holdings [JSE:EOH] got a boost after they released a media statement earlier on today. The statement was in relation to the media coverage by amaBhungane on EOH in April of this year. The media release stated that after a detailed inquiry and extensive interactions with amaBhungane no evidence of any wrongdoing was found on the part of EOH. The share price broke above R100 per share to reach an intra-day high of R104.00 per share. It closed at R99.96 per share, up 3.59% for the day.

Miners had good day out as they inched up higher. Top movers included African Rainbow Minerals [JSE:ARM], Lonmin [JSE:LON] and Harmony Gold [JSE:HAR] which gained 3.23%, 4.01% and 3.29% respectively.

Tsogo Sun [JSE:TSH] ended the day amongst the biggest losers as it lost 3.07%. Barloworld [JSE:BAW] gave up some of the gains from the previous day as it closed the day 2.48% weaker and MTN [JSE:MTN] was among the biggest losers in the Top-40 Index as it lost 2.73%. Banking stocks Barclays Africa [JSE:BGA] and Nedbank [JSE:NED] closed the day 1.85% and 1.18% softer.

The JSE All-Share Index closed 0.38% firmer whilst the Top-40 Index gained 0.50%. The Financials Index came under pressure from the weaker Rand to close the day down 1.01%. The Industrials Index and the Resources Index gained 0.87% and 0.51% respectively.

The Rand softened to an intra-day low of R14.05 against the greenback before it retraced slightly to trade at R13.96/$ when the JSE closed. On the back of this weakness in the Rand, South African treasury bonds traded softer and the benchmark 10-year R186 bond yield climbed to trade at 9.195% when the JSE closed.

Gold opened the day weaker as the US dollar held on to overnight gains. However the greenback slid in the afternoon despite better than expected durable goods and new home sales economic data out of the USA. As a result Gold managed to bounce slightly from today’s lows of $1271.06/Oz to trade at $1276.50/Oz when the JSE closed.

Platinum was firm earlier on but it subsequently lost ground to trade in the red. When the JSE closed it was trading at $921.40/Oz. Palladium held on to its gains to trade at $969.42/Oz when the JSE closed.

Brent Crude tried to jump after the release of the weekly US Crude Oil Inventories numbers but it failed to maintain that momentum as it subsequently slid. It was trading in the red when the JSE closed as it was recorded at $58.30 per barrel.