Another good day for the rand and our local markets. The rand firmed to R13.61 against the greenback, despite any uncertainty around the outcome of the ANCs succession race and the U.S. Senate’s push to finalise a tax bill that Trump could sign into law before the end of the year.

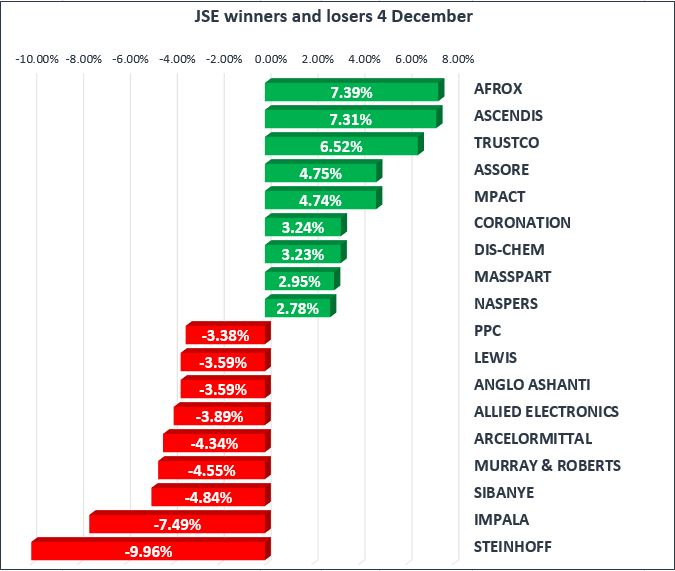

We saw the All-Share index add 0.27%, whilst the blue-chip Top40 added 0.36%. Financials again closed in the green, gaining 0.18% with industrials recovering slightly from Friday’s levels, gaining 0.60%. This was countered by the resource stocks where we saw a drop of 0.57% with the gold miners giving away 3.29% on the day with the Gold price trading at $1277/ounce.

Brent Crude Oil weakened today trading at $62.86/bbl following data that showed U.S. shale drillers added more rigs.

Steinhoff International Holdings N.V. [JSE:SNH] was the major loser on the day after they released a SENS announcement stating that an unaudited form of their consolidated financial statements will be released on the 6th of December as the supervisory board and auditors have not yet finalised their review of certain matters and circumstances regarding the investigation in Germany.

It was a mixed day for the global indices with Australia’s ASX & China’s Shanghai Composite closing down, whilst the Hang Seng finished the day positive. In Europe, we saw markets claw back some of the losses from Friday with the DAX, CAC & FTSE all positive at the time of writing. While over in the U.S. the S&P 500 and the Dow 30 opened firmer and the Nasdaq was marginally weaker.

Lastly today saw an important breakthrough for Britain and Brexit talks after they reached a compromise with Ireland on the border between the Republic and Northern Ireland.