The JSE closed softer on Friday with losses form the bourse’s biggest mining giants yet again driving it lower.

Losses mounted for mining giants Anglo American PLC and BHP Group in London and Sydney respectively, as iron ore fell over news that Chinese regulators were being encouraged to take measures over the recent spike in iron ore prices, which have been attributed to excessive speculation. This negative sentiment filtered onto miners on the JSE which tracked mostly lower on the day.

In Asian markets trading, the Hang Seng closed relatively flat as it shed 0.07% while in mainland China the Shanghai Composite Index closed 0.52% firmer. In Japan, the Nikkei gained 0.2%. In Europe and the USA counters turned red after the release of a better than expected US jobs report which showed that the US economy had added 224 000 jobs in June, which was better than the forecasted 160 000 jobs. The improved jobs numbers mean spread betters will cut their odds for a rate hike which does not incentivize investors to buy riskier assets such as stocks.

The false breakout below R14/$ did not last for the rand as the local currency slumped to a session low of R14.27/$ on Friday. At 17.00 CAT the rand was trading 1.21% weaker at R14.19/$.

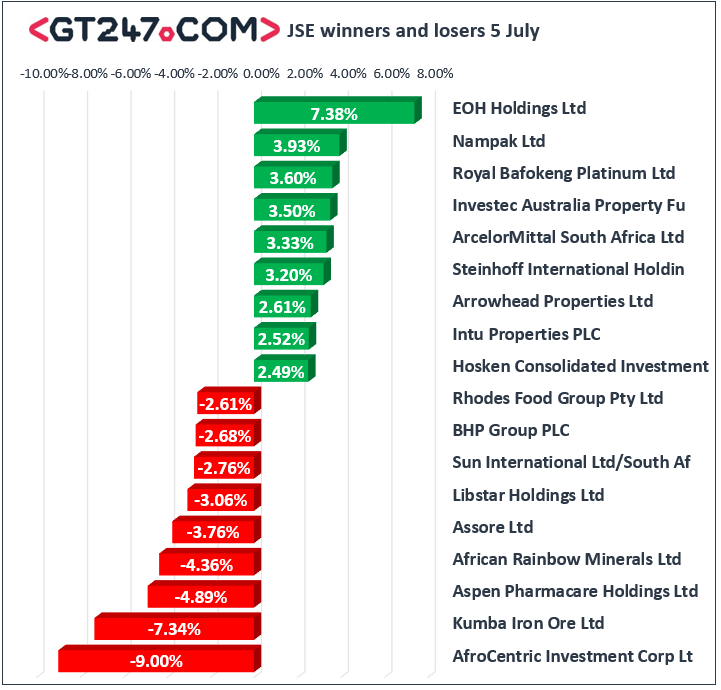

On the JSE, Kumba Iron Ore [JSE:KIO] fell to its lowest level in over a year as it reached a session low of R466.77 before it closed at R471.68 after falling 7.34%. Anglo American PLC [JSE:AGL] lost 2.08% to close at R378.80, while BHP Group [JSE:BHP] dropped 2.68% to end the day at R345.92. Aspen Pharmacare [JSE:APN] came under pressure following the release of a statement indicating that discussions between the company and a potential partner in Europe had fallen. The stock closed 4.89% lower at R99.64. Gold miners also recorded a weak session as the gold metal price retreated. Gold Fields [JSE:GFI] closed 2.27% weaker at R71.93, while AngloGold Ashanti [JSE:ANG] lost 1.46% to close at R247.43.

EOH Holdings [JSE:EOH] recorded another stellar session as it surged 7.38% to close at R24.00. Nampak [JSE:NPK] managed to add 3.93% to close at R11.38, while Brait [JSE:BAT] rose 1.68% to close at R19.42. Listed property stocks recorded decent gains on the day with stocks such as Investec Australia Property Fund [JSE:IAP] gaining 3.5% to close at R14.50, Arrowhead Properties [JSE:AWA] added 2.61% to R3.54, and Intu Properties [JSE:ITU] closed at R13.83 after gaining 2.52%. Rand hedge British American Tobacco [JSE:BTI] rose to close at R532.91 after gaining 1.44%.

The JSE all-Share index eventually closed 0.44% weaker while the JSE Top-40 index shed 0.4%. The Industrials index advanced 0.36%, however the Resources and Financials indices fell 1.91% and 0.25% respectively.

At 17.00 CAT, Platinum was down 3.34% at $806.85/Oz, Palladium was flat to trade at $1565.60/Oz, and Gold had lost 1.51% to trade at $63.92/Oz.

Brent crude was trading 0.96% weaker at $63.92/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.