The JSE rebounded to close firmer on Wednesday on the back of broad-based gains across all the major indices.

The local bourse had a strong outing despite relatively modest gains across most global equity indices. Investors were closely watching the US Fed chair, Jerome Powell’s testimony before US congress which started this afternoon. Following last week’s improved US jobs data, market participants had become skeptical that the US Fed would not cut rates at the next policy meeting. However, Jerome Powell signaled the Fed was still open to a rate cut in July as he described it as almost a certainty.

The US dollar plummeted on the back of this testimony which saw emerging market currencies surge. The rand had struggled earlier as it fell to a session low of R14.23/$, however it rallied as the testimony took place to a session high of R14.04/$. At 17.00 CAT the rand was trading 0.66% firmer at R14.07/$.

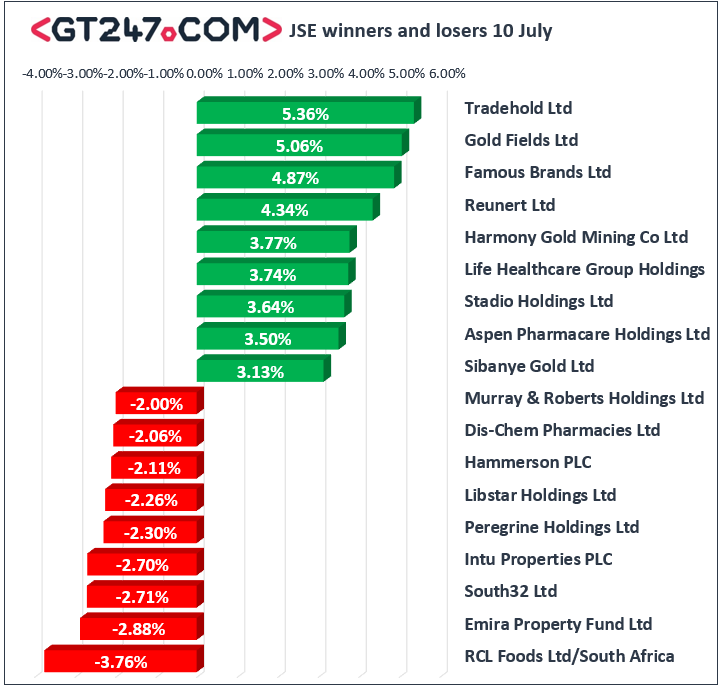

On the JSE, gold miners led the gains on the day with stocks such as Gold Fields [JSE:GFI] climbing 5.06% to close at R77.05, while Harmony Gold [JSE:HAR] advanced 3.77% to close at R33.82. Famous Brands [JSE:FBR] also recorded significant gains as it closed 4.87% to end the day at R91.58, while Reunert [JSE:RLO] added 4.34% to close at R71.70. Despite opening weaker Aspen Pharmacare [JSE:APN] found some momentum as it eventually closed 3.5% higher at R105.00, while Sibanye Stillwater [JSE:SGL] peaked as high as R17.14 before it settled 3.13% higher at R16.81. Naspers [JSE:NPN] was spurred by the firmer close in its Hang Seng listed associate, as it closed 2.09% firmer at R3471.10.

ArcelorMittal [JSE:ACL] plummeted in today’s session following the release of a trading statement which highlighted difficult trading conditions as the company is expecting to report significant losses. The company is revealed its plans to cut costs through at least 2000 job cuts. The stock eventually closed 15.9% lower at R2.91. Diversified miner South32 [JSE:S32] lost 2.71% to end the day at R29.80, Dis-Chem Pharmacies [JSE:DCP] struggled to end the day 2.06% lower at R24.24. Emira Property Fund [JSE:EMI] closed 2.88% weaker at R13.49 following the release of statement indicating the company’s non-binding proposal to acquire all the issued share capital of SA Corporate Real Estate.

The JSE Top-40 index eventually closed 1.15% firmer while the JSE All-Share index climbed 1.27%. In a complete turnaround from the prior session all the major indices closed firmer. Industrials added 1.52%, Financials gained 1.19%, while Resources added 0.87%.

Metal commodities advanced on the day. At 17.00 CAT, Gold was 0.57% firmer at $1405.93/oz, Palladium was up 2.51% at $1587.90/Oz, and Platinum had gained 1.7% to trade at $825.70/Oz.

Brent crude was supported by the big drop in US crude oil inventories as indicated by data released this afternoon. The commodity was trading 2.96% firmer at $66.06/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.