Local stocks found significant traction in the afternoon session as they tracked a similar surge in global markets.

The surge in stocks was on the back of positive news from trials being conducted on a potential treatment for the coronavirus. With most economies looking to partially reopen their economies, this brought a jump across most asset classes including commodities. Information released by Gilead Sciences stated that the drug had shown to benefit patients who took the drug at an early stage of the illness, while it was less effective for later stage patients. Before this news, local stocks had traded mostly flat on the day.

The rand recorded one of its best days this month as it strengthened against the greenback to peak at a session high of R18.25/$. At 17.00 CAT, the rand was trading 1.97% firmer at R18.28/$.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

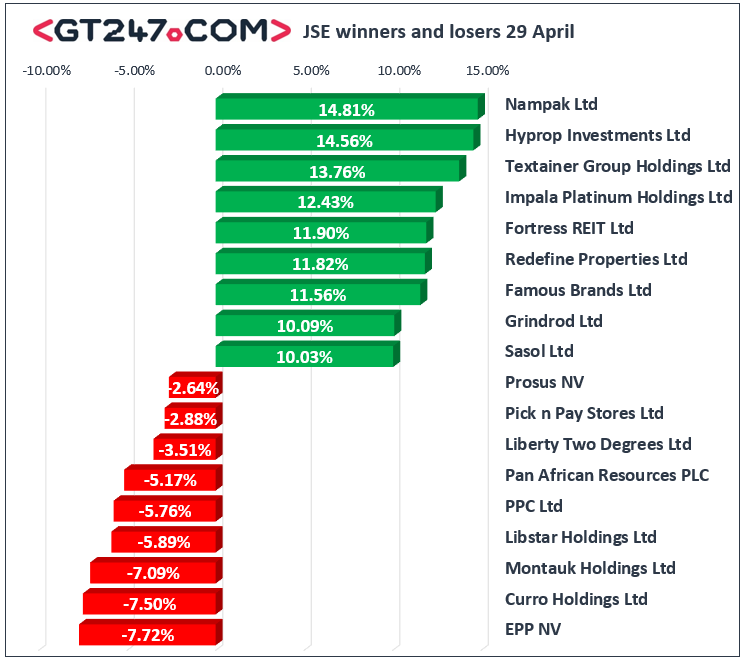

On the JSE, financials led the charge as gains were recorded for Standard Bank [JSE:SBK] which climbed 8.35% to close at R101.08, Old Mutual [JSE:OMU] which rose 5.7% to close at R13.35, and Sanlam [JSE:SLM] which added 4.3% to close at R59.88. Sasol [JSE:SOL] closed as one of the day’s biggest gainers after the stock surged 14.81% to close at R1.55, while Famous Brands [JSE:FBR] added 11.56% to close at R41.99. Some listed property stocks recorded decent gains on the day which saw stocks such as Hyprop Investments [JSE:HYP] gain 14.56% to close at R17.00, while Redefine Properties [JSE:RDF] added 11.82% to close at R2.27. Significant gains were also recorded for Sasol [JSE:SOL] which advanced 10.03% to close at R85.00, as well as Barloworld [JSE:BAW] which closed at R67.79 after gaining 9.06%.

Curro Holdings [JSE:COH] struggled considerably as it fell 7.5% to close at R9.99, while EPP NV found itself amongst the day’s biggest losers after it tumbled 7.72% to close at R4.66. Retailer, Pick n Pay [JSE:PIK] fell 2.88% to close at R59.73, while its sector peer The Spar Group [JSE:SPP] lost 2.46% to close at R181.69. TV content provider, Multichoice [JSE:MCG] retreated 1.13% as it closed at R87.54, while index heavyweight Naspers [JSE:NPN] shed 0.92% to close at R2923.00. Declines were also recorded for Pan African Resources [JSE:PAN] which lost 5.17% to close at R3.30, as well as MTN Group [JSE:MTN] which closed at R47.20 after dropping 2.18%.

The JSE All-Share index eventually closed 1.66% higher while the blue-chip JSE Top-40 index gained 1.59%. The Industrials index shed 0.17%, while the Resources and Financials indices managed to gain 3.38% and 4.33% respectively.

Brent crude also jolted with the news of the positive drug trials which saw it trading 8.18% higher at $24.59/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.47% firmer at $1700.49/Oz, Platinum had gained 0.72% to trade at $777.32/Oz, while Palladium was trading 2.85% higher at $1968.17/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.