The exuberance from the prior session faded on Tuesday as the JSE retreated on the back of a more cautious tone from market participants.

Despite the rally on Monday sentiment quickly turned pessimistic across most global markets after manufacturing PMI data showed that most economies were indeed slowing. The Australian central bank also took a looser monetary policy stance as it cut benchmark interest rates by 25 basis points to 1.00%, as it highlighted slowing inflation and economic growth as key fundamentals that led to its decision. With most major central banks taking a more accommodative monetary policy, investors are increasingly concerned over global growth prospects which have been exacerbated by the trade war between China and the USA.

Stocks in Hong Kong resumed trading today after having been closed for a holiday on Monday. Most equity markets struggled for direction as market participants sort for new clues on the trade war from either Donald Trump’s social media content and other news sources.

Volatility was also the main constant for the rand which fluctuated between gains and losses despite the US dollar trading within a very narrow range. The rand fell to a session low of R14.21/$ before it managed to recoup its losses to trade 0.25% firmer at R14.09/$ at 17.00 CAT.

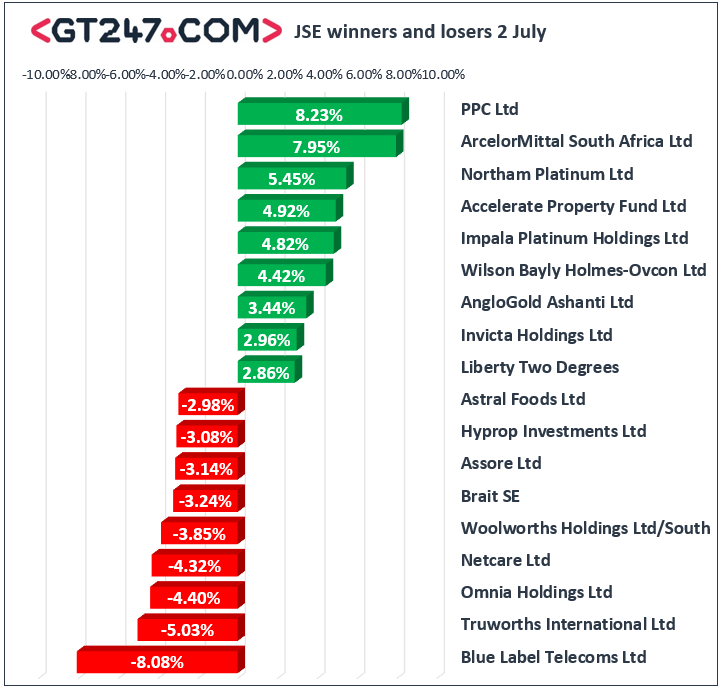

Rand sensitives traded under the most pressure in today’s session as they fell mainly due to the weakening rand. Truworths [JSE:TRU] lost 5.03% to close at R68.85, Woolworths [JSE:WHL] dropped 3.85% to close at R46.51, and Pick n Pay [JSE:PIK] closed 2.49% lower at R66.30. Banker, FirstRand [JSE:FSR] retreated 2.27% to end the day at R67.15, while Nedbank [JSE:NED] lost 2.26% to close at R250.00. Blue Label Telecoms [JSE:BLU] struggled significantly as it tumbled 8.08% to close at R4.55, while Netcare [JSE:NTC] lost 4.32% to end the day at R17.06.

Gold mining stocks recouped some of the prior session’s gains as they advanced in today’s session. AngloGold Ashanti [JSE:ANG] rose 3.44% to close at R244.94, while Gold Fields [JSE:GFI] inched up 0.26% to R73.39. Cement maker PPC Limited [JSE:PPC] closed at R5.00 after rallying 8.23%, while construction firm WBHO [JSE:WBO] gained 4.42% to close at R112.89. Platinum miner Northam Platinum [JSE:NHM] added 5.45% to close at R59.96, while its sector peer Impala Platinum [JSE:IMP] rose 4.82% to close at R73.34. EOH Holdings [JSE:EOH] eventually closed at R19.82 after gaining 1.85%.

The JSE Top-40 index closed 0.71% lower while the broader JSE All-Share index fell 0.65%. The Resources index fell short of closing firmer as it closed 0.09% weaker. The Industrials and Financials indices added 0.69% and 1.06% respectively.

Brent crude tumbled in today’s session as focus shifted to the trade war concerns. The commodity was recorded trading 2.64% weaker at $63.24/barrel just after the JSE close.

At 17.00 CAT, Platinum was down 0.34% to trade at $829.00/Oz, Palladium was up 0.48% to trade at $1556.10/Oz, and Gold was 0.7% firmer at $1394.06/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.