The local equity market opened the day firmer as investors shook off the Ramaphosa cabinet announcement hangover. In what has become a trend or tradition, the President delayed his announcement as he was locked behind closed doors plastering together a cabinet that would live up to the expectations of the new dawn mantra he based his election campaign on. In this morning trade, the local bourse rallied in unison with international markets.

Africa’s largest diversified packaging group Nampak released results first half results, this morning. The packaging giant has found the going tough in the first half sighting several headwinds which have hampered growth and repatriation of dividends to South Africa. These headwinds saw revenues decline by 4% and trading profit declined by 18%.

Inflation from the factory gate (Producer Price Inflation (PPI)) increased to 6.5% in the month of April up from 6.2%, this number was the highest recorded in 2019 and the highest since November of 2018. Major drivers of this were petroleum and chemical prices which increased on the back of a weaker local currency and firmer global oil prices. This increase in inflation indicates that prices increased at a faster pace than had been anticipated.

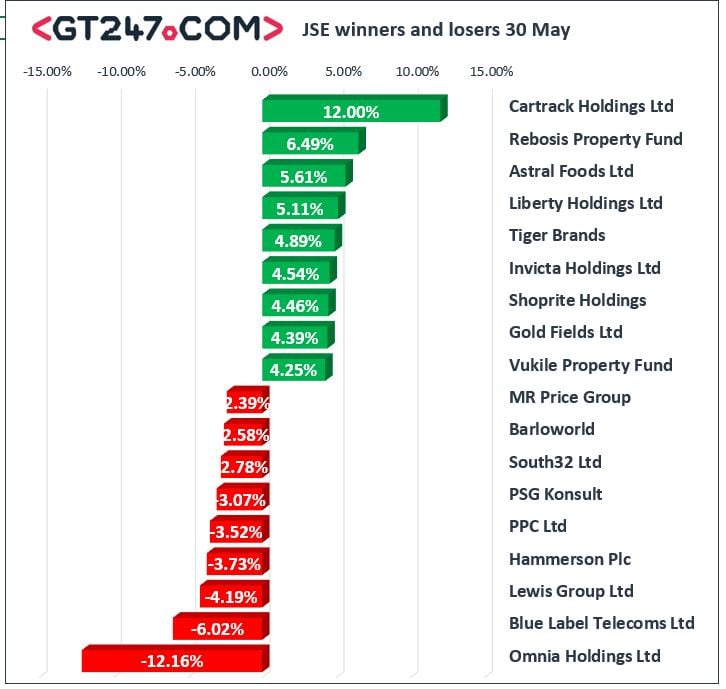

Gains were recorded by SA Inc shares on the day with banks, retailers and local industrial counters bouncing to erase some of the loses recorded yesterday. Notable gains were chalked up by Cartrack[JSE:CTK] which closed the day up 12% to close at 1960c, Rebosis [JSE:REB] gained 6.49% to close at 82c. Astral Foods [JSE:ARL] gained 5.6% to end the day at 16763c.

Major losses were recorded by Omnia Holdings Ltd [JSE: OMN], the local chemicals company continues to come under pressure to close at 4660c easing 12.16% on the day. Blue Label Telecoms Ltd was also softer on the day to close the day at 375c shedding 6.02%.

The JSE All-Share index closed 1.28% firmer while the JSE Top-40 index gained 1.35%. The Resources index was firmer on the day gaining 0.59%. The Industrials and Financials indices gained 1.01% and 2.59% respectively.

At 17.00 CAT, Palladium was 1.92% firmer to trade at $1369/Oz, Platinum was also firmer recording gains of 0.4% to trade at $794.90/Oz, whilst Gold was 0.11% firmer at $1282.55/Oz.

Brent crude was marginally softer on Thursday shedding $0.59 at the time of writing. A barrel of crude was changing hands at $67.28 per barrel.

The local unit was firmer on the day as the market embraced the growth orientated cabinet that was announced by President Ramaphosa last night. The Rand was trading at 14.71 to the USD, 16.36 to the Euro and 18.50 to the Pound Sterling.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.