You wanted the ability to choose which accounting system your trading account functioned on, so we gave you the choice.

So, what’s the big fuss about and which one should I choose?

There is one main difference between the two systems, with the Hedging system you can be long and short the same instrument at the same time.

If that does not give you clarity on which one to choose, here is a little bit more info on both systems:

Netting

With this system, you only have one common position for a symbol/instrument at a given time. Any subsequent trades (deals) done on this symbol will net off against your current holding, either increasing it, decreasing it, closing it out or going in the other direction.

Pros:

- Only have to manage one position per symbol/instrument.

- You know your overall volume weighted breakeven/entry level per position.

- You can phase in and out of a trade.

Cons:

- You can’t place partial S/L or T/P orders linked to the position. You can place Buy Stop or Sell Stop orders, but you must remember to cancel them once the position is closed.

Let’s look at an example:

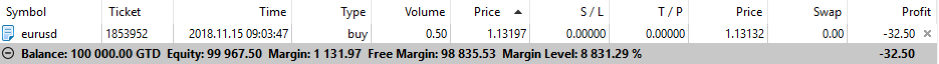

You execute a Buy trade on EURUSD with a risk of 0.5

You execute a Sell trade on EURUSD with a risk of 0.2. Your open positions view looks as follows:

Hedging

With the Hedging accounting system, you can have multiple positions per symbol/instrument at the same time. Any subsequent trades (deals) done after your original trade on a symbol will open another completely independent trade, irrespective of size or direction.

Pros:

- You can have a long and a short position open at the same time on a given instrument.

- You can place multiple S/L or T/P orders linked to the positions.

- You can graphically see your multiple entry levels.

Cons:

- If you trade very actively, the portfolio view can get a bit clustered.

- You aren’t shown your average volume weighted breakeven point. You could work it out manually from the data provided.

- You can’t phase into a trade or build a single position.

Let’s look at an example:

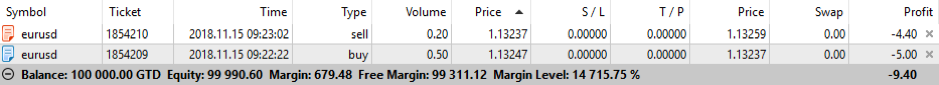

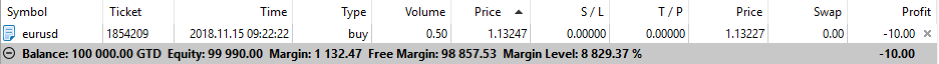

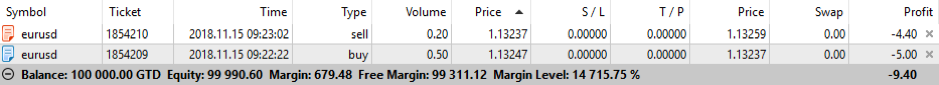

You execute a Buy trade on EURUSD with a risk of 0.5

You execute a Sell trade on EURUSD with a risk of 0.2. Your open positions view looks as follows:

Each system has its Pros and Cons, but luckily as a GT247.com client, you now have the choice.

Frequently asked questions:

1. I already have a Netting account, how do I change to Hedging?

- You will need to register a new account at www.gt247.com and select "Hedging". You will then have two accessible accounts with GT247 and you can log into either one to trade your preferred strategy.

2. Do i need to FICA again if I already have a verified account?

- No, all you will need to do is email supportdesk@gt247.com and advise the team of your verified account and of your new account that you would like FICA'd. You can do this by adding both your old MT UserID and new MT UserID into the description of your email to our team. They will then verify your account based on the previous account.

3. Can I transfer money between account?

- Yes this is a manual process and you can request this be done via email to supportdesk@gt247.com

For more information on Netting vs Hedging, please check into our FAQ and Solutions portal HERE