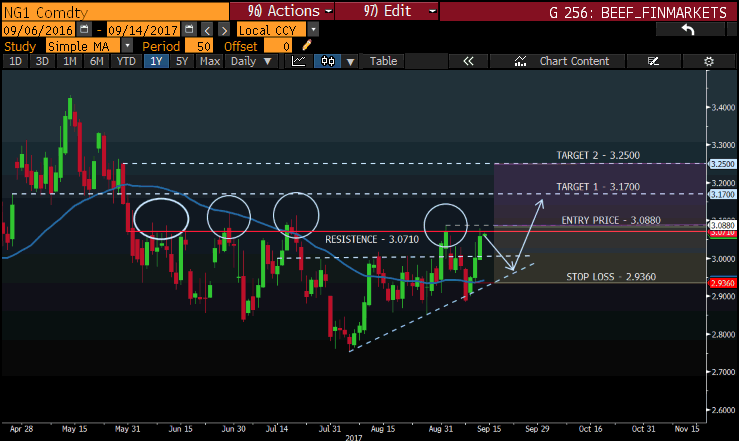

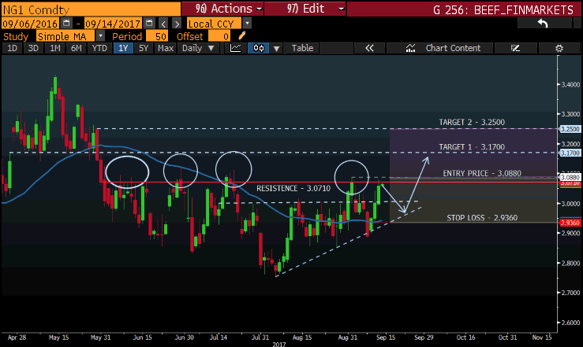

Technical Take:

I have been watching natural gas for a while now and it seems to be on the point of breaking out of the $ 3.07/ mmBTU resistance zone. The price has been testing this line over the last couple of months and it looks like it might break out soon and move higher.

I would wait on a close above $ 3.07/ mmBTU as confirmation to place the trade.

Take note: The Natural gas storage numbers/ inventory number will be released today and will affect the price movement and hopefully push the price I our favour and move higher. The previous week’s number was 65B and the forecast for this week is 83B.

Trade Summary Natural Gas [NG]:

- Entry: Buy (Long) close above $3.08

- Stop: $ 2.93/ mmBTU

- Target Price 1: $ 3.17/ mmBTU

- Target price 2: $ 3.25/mmBTU

Always remember to apply your risk management measures before placing your trades as this will keep you trading in the markets.

Read more notes by Barry HERE.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108