The JSE recorded gains on Friday as the local bourse was buoyed by retailers and financials stocks.

The move higher in Rand sensitive stocks was mainly as a result of the Rand which strengthened significantly against a basket of major currency pairs. The Rand gained enough momentum to break below R14/$ as it reached an intra-day high of R13.95 against the greenback. At 5pm, the USD/ZAR had retraced slightly to trade at R14.04/$.

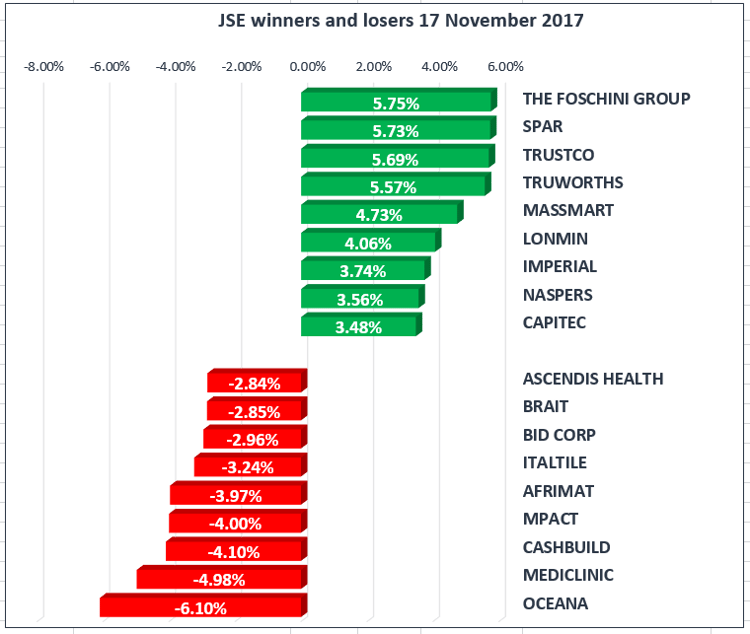

Retailers Truworths [JSE:TRU] and The Foschini Group [JSE:TFG] were among the biggest gainers of the day as they closed up 5.57% and 5.75% respectively. Spar Group [JSE:SPP] recorded another day of gains to close the day up 5.73%.

Naspers [JSE:NPN] reached a new all-time high of R3896.51 per share. This was on the back of the fresh all-time high of HK$405.00 reached by Tencent Holdings in today’s session on the Hang Seng. This supported the JSE All-Share Index which broke above 60 000 points once again. Naspers [JSE:NPN] closed at R3845.00 per share, up 3.56% for the day.

Steinhoff [JSE:SNH] continued climbing from its recent slump to gain another 1.70%, whilst Dis-Chem [JSE:DCP] and Imperial Holdings [JSE:IPL] climbed 1.66% and 3.74% respectively.

Mediclinic was among the biggest losers of the day as it lost 4.98% whilst blue chip index heavyweight, Richemont [JSE:CFR], shed 2.57%. Consolidated Infrastructure Group [JSE:CIL] which has been attempting a recovery from the recent slump, came under pressure in today’s session as it dropped 18.32%. Brait [JSE:BAT] continued to slide as it lost another 2.85%.

The JSE All-Share Index closed up 0.97%, whilst the Top-40 Index gained 0.99%. The Financials Index benefitted from the firmer Rand to close up 1.53% whilst the Industrials Index gained 1.40%. The Resources Index was 0.59% weaker.

Metal commodities traded relatively firmer today which saw Gold recording modest gains to peak at an intra-day high $1287.18/Oz. This strength in Gold was due to a relatively weaker US dollar earlier on. The US dollar did have a minor recovery after the release of better than expected US Building Permits and Housing Starts data. The precious metal was trading at $1285.27/Oz just after the JSE closed.

Palladium peaked at an intra-day high of $997.13/Oz whilst Platinum peaked at $944.35/Oz. This supported stocks such as Impala Platinum [JSE:IMP] and Royal Bafokeng Platinum [JSE:RBP] as they closed up 0.43% and 1.31% respectively. Palladium was trading at $992.40/Oz just after the JSE closed, whilst Platinum was trading at $942.38/Oz.

Brent Crude gained more than 1% to peak at 62.30 per barrel. When the JSE closed it was recorded at $62.04 per barrel.