Moody's ratings review update

In the last couple of days, the news wires have been a buzz about today’s Moody’s ratings review update. The much-anticipated review comes a few days after Jacob Zuma (sorry I forgot the President bit), performed a Houdini act in parliament surviving yet another vote of no confidence.

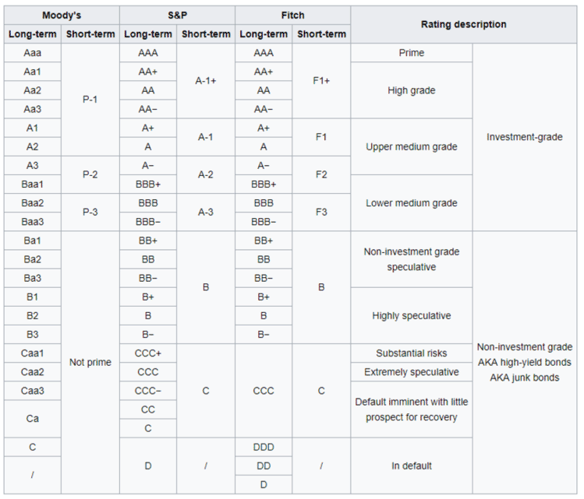

So many people might say "why should we care about ratings agencies, are they not imperial forces and instruments of the west that have an agenda to oust Jacob Zuma". I say no, Moody’s, Standard and Poor’s and Fitch are the powerhouses within the global ratings business and review all nations credit ratings. The three make up approximately 95% of the ratings business with Moody’s and Standard and Poor’s with the lion’s share of the market with a combined 80% of global business. The role of the ratings agencies is to evaluate a country or a business that seeks to borrow money based on a set matrix. The rating agency can then grade the borrower and award them a rating. The rating that is awarded to the borrower determines how lenders on the open market price their loans to them, so for instance country Z with a Aaa rating (the best investment grade rating) will borrow money at a more favourable rate than country Y that has a rating of Baa3(the lowest investment grade rating). Country Z has better quality paper than country Y and are deemed to be less likely to default on a loan. A rating can be compared to a grade given to a pupil in school, (South African matric pass rates do not apply here), global ratings (standards) are applied to all nations.

How will this affect my investments? So why should I care? Moody’s remain the only ratings agency in the pack of three to apply an investment grade rating to both the locally denominated debt and the foreign currency denominated debt. If Moody’s cut these ratings lower, we could see a domino effect with yields on South African Bonds going higher. These bonds will include Government bonds and this will affect State owned enterprises such as ESKOM as their ratings will also come under review; the banks will also come into focus and their ratings will more than likely be adjusted in the same direction. So, if we do see any downgrade, watch out for a negative movement in the USDZAR currency pair and a rerating of all interest sensitive shares on the JSE, this could however be positive for Rand hedge stocks. A weaker Rand could see more inflationary pressure and all the work done at 370 Helen Joseph Street could all go out of the window.

We anticipate that Moody’s will announce their review after the market closes today 11 August 2017. It is anticipated that there will be no adjustment to the rating and a negative outlook on South Africa will remain. A stay of execution some might call it, political developments could change the ratings outlook towards the beloved Republic. The unfortunate bit in playing in the international market is that we cannot adjust the pass market a fail is a fail.

Source: Wikipedia

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Download GT247.com MobiTrader app and start trading forex from your mobile phone immediately with R100 000 demo money: