Stocks on the JSE edged marginally higher on Friday after a difficult week of trading in which investors shunned riskier assets due to weak economic data.

On Friday investors now shifted their attention to key jobs data out of the USA which came in a relatively mixed. The US economy managed to add 136 000 jobs in September which was slightly worse than the forecasted number of 145 000 jobs. However, the US unemployment rate fell to 3.5% from a prior recorded level of 3.7% which gave investors some glimmer of hope that the economy wasn't at the brink of collapse. This data saw US markets open firmer on the day, while the major indices in Europe also advanced.

On the currency market the rand extended its gains against the greenback as it peaked at a session high of R15.06/$. The rand was recorded trading 0.66% firmer at R15.04/$ at 17.00 CAT.

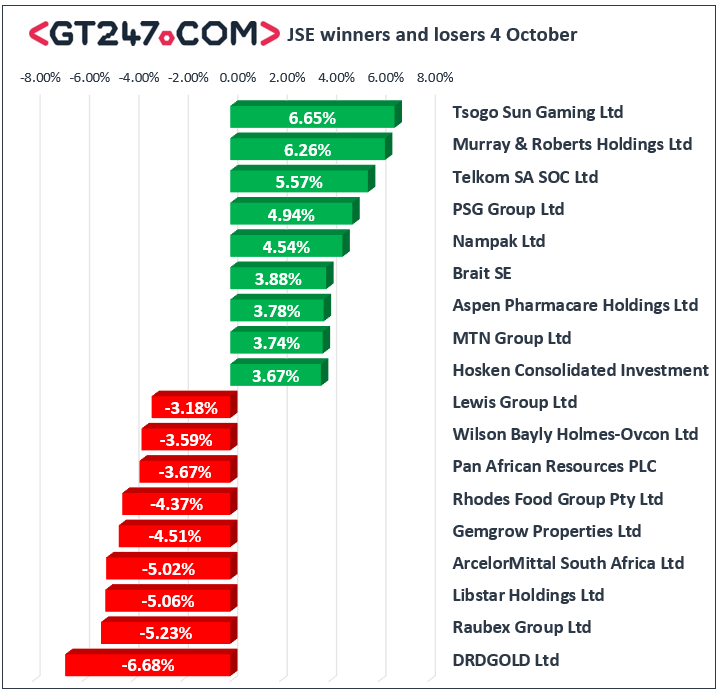

Rand sensitives were bolstered by the firmer rand as they traded mostly firmer on the day. Telecoms provider Telkom [JSE:TKG] surged 5.57% to close at R73.54, while MTN Group [JSE:MTN] climbed 3.74% to close at R95.75. PSG Group [JSE:PSG] had a stellar outing as it gained 4.94% to end the day at R224.11, while African Rainbow Capital [JSE:AIL] added 3.6% to close at R4.61. Retailers also advanced on the day with gains being recorded for Pick n Pay [JSE:PIK] which advanced 3.29% to R59.09, and Massmart [JSE:MSM] which closed at R44.40 after adding 1.37%. Other significant gainers on the day included Bid Corporation [JSE:BID] which gained 2.3% to close at R333.50, and Capitec Bank Holdings [JSE:CPI] which added 2.22% to close at R1328.88.

Construction firm Raubex Group [JSE:RBX] came under significant pressure as it fell 5.23% to end the day at R19.77, while food producer Rhodes Food Group [JSE:RFG] lost 4.37% to close at R14.00. Gold miners retreated in today’s session as losses were recorded for DRD Gold [JSE:DRD] which lost 6.68% to close at R6.99, and Gold Fields [JSE:GFI] which dropped 2.09% to close at R78.27. Anglo American Platinum [JSE:AMS] gave back some of the prior session’s gains as it lost 2.54% to close at R1030.69, while diversified miner South32 [JSE:S32] fell 1.56% to end the day at R24.57. UK focused listed property stock, Intu Properties [JSE:ITU] lost 2.28% as it close at R7.73, while Capital & Counties [JSE:CCO] fell 1.74% to end the day at R42.33.

The JSE All-Share index eventually closed 0.67% firmer while the blue-chip JSE Top-40 index added 0.48%. The Resources index struggled on the day eventually closing 0.19% weaker. The Financials and Industrials indices managed to record gains of 1.32% and 0.69% respectively.

Brent crude recorded a relief bounce as it was recorded trading 1.4% higher at $58.52/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.11% firmer at $1506.66/Oz, Palladium had rallied 1.7% to trade at $1683.95/Oz, and Platinum was down 1.32% at $876.60/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.