Miners rally as Rand sinks in troubled waters.

Quality easing or was it supposed be quantitative easing one wonders. Has the ANC SG introduced a new economics phrase or was he merely telling us that the quality of the output from government and the ANC has declined and will decline in future? It does not really matter what was meant, all that is true at this juncture ids that the South African economy is in dire straits and needs intensive care to pull it out of this economic coma.

Equity markets continued to rally on Wednesday as the voices of a US rate cut rang louder across global markets. Asian markets bounced off session lows to trade mainly in the black, the Nikkei was up 1.8%, whilst the Hang Seng gained 0.5% and the Asx200 was up 0.41%. The Shanghai CSI 300 closed the day 0.04% in the red to trade at 3597 points.

GDP numbers released out of Australia on the day indicated that the economy grew by 0.4% in the last quarter which was below the market forecast of 0.5%. This point justifies the RBA’s move yesterday to cut interest rates by 25 basis points.

The Standard Bank PMI for May came in at 49.3, declining from 50.3. An index reading of 50 or more represents an expansion, a reading below 50 suggests that the economy is contracting. This is in line with the GDP numbers released yesterday which showed a decline in the economy.

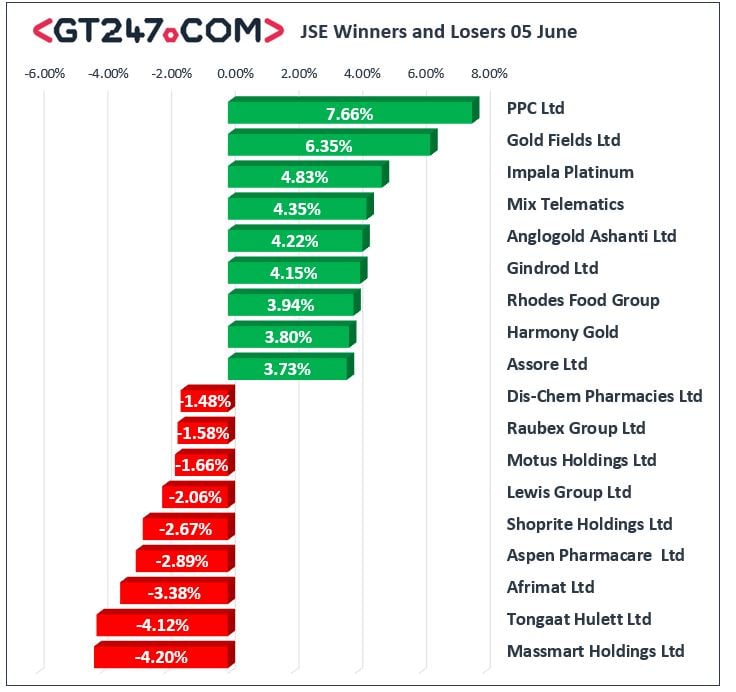

The miners on the JSE continued their rally as a weaker Rand provided them with some support. The familiar suspects made the gainers list today as Gold Fields Ltd [JSE:GFI], Impala Platinum Ltd [JSE:IMP], AngloGold Ashanti Ltd [JSE:ANG], and Harmony Gold Ltd [JSE:HAR], advanced 6.35%, 4.83%, 4.22% and 3.8% respectively.

The worst performing shares on the day were led by out of favour Massmart Ltd [JSE:MSM], which eased 4.2% to trade at 6185c at the close of business. The former giant posted an intraday low of 6152c the lowest the share price has been in 10 years.

The JSE All-Share index closed 1.01% firmer whilst the JSE Top-40 index gained 1.04%. The Resource index rallied once more advancing 1.53%, the Industrials were firmer inching up 1.06% whilst the Financials only managed a 0.41% gain. Other notable losses were recorded by Tongaat Hulett Ltd [JSE:TON], Afrimat Ltd [JSE:AFT] and Aspen [JSE:APN], which shed 4.12%3.38% and 2.89% respectively.

The $USD eased today, however this did not give the commodities any room to rally. At 17.00 CAT, Palladium was 1.36% weaker to trade at $1322/Oz, Platinum also eased shedding 1.07% to trade at $810.10/Oz, whilst Gold was 0.3% firmer to trade at $1332.55/Oz.

Brent crude continued to slide today dipping below the $60/barrel level to trade at $59.97.

The Rand was on the backfoot on Wednesday breaching R14.80 against the dollar in afternoon trade. At 17:00 CAT the Rand was trading at R14.86 against the USD, R16.71 to the Euro and R18.90 to the Pound Sterling.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.