The JSE closed weaker on Thursday as profit-taking swamped the market following the strong close recorded on Wednesday.

Globally, benchmark Treasury yields for the USA and the United Kingdom continued to rise, and South African Treasury yields also followed the same trend. This aided in putting pressure on local equities which traded mostly weaker on the day. The Rand weakened against the greenback as the US dollar found renewed strength. The Rand was trading at R12.59/$ at 17.00 CAT.

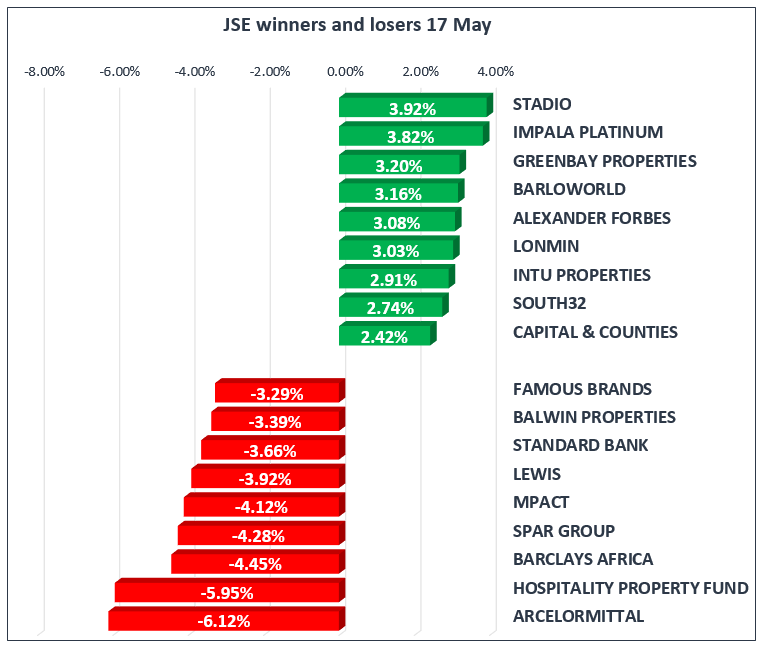

Gains were relatively limited on the JSE which saw Impala Platinum [JSE:IMP] and Greenbay Properties [JSE:GRP] close the day up 3.82% and 3.2% respectively, to end amongst the session’s biggest gainers. Lonmin [JSE:LON] and South32 [JSE:S32] added 3.03% and 2.74% respectively, whilst Stadio Holdings [JSE:SDO] and Intu Properties [JSE:ITU] gained 3.92% and 2.91% respectively.

Oil and gas producer, Sasol [JSE:SOL] gained 1.86% to close at R478.77 per share, to lead gains amongst the blue-chip counters. Reinet [JSE:RNI] and Richemont [JSE:CFR] gained 1.33% and 1.44% respectively, whilst Investec Limited [JSE:INL] closed 1.45% firmer, as it was buoyed by the release of its full year earnings results which were largely positive.

Rand sensitive stocks such as banks and retailers traded under pressure due to the weak Rand. Retailers, Spar Group [JSE:SPP] and Shoprite [JSE:SHP] lost 4.28% and 1.78% respectively, whilst bankers, Barclays Africa [JSE:BGA] and Standard Bank [JSE:SBK] shed 4.45% and 3.66% respectively.

Famous Brands [JSE:FBR] released a trading statement which highlighted that their UK based business, GBK Restaurants, recorded another operating loss for the full year ended 28 February. The share price was negatively impacted as it ended the day down 3.29%. Liberty Holdings [JSE:LBH] lost 3.08% to close at R124.78 per share, whilst ArcelorMittal [JSE:ACL] lost 6.12%.

The JSE All-Share Index closed 0.75% weaker, whilst the JSE Top-40 Index lost 0.83%. The Industrials and Financials Indices came under pressure to lose 1% and 2.04% respectively, however the Resources Index had another reprieve as it gained 0.88%.

Gold traded within a $10 range which saw it reach a session low of $1285.24/Oz before it rebounded to trade at $1289.84/Oz at 17.00 CAT. Platinum and Palladium traded softer on the day they were trading at $889.56/Oz and $986.55/Oz at 17.00 CAT.

Brent Crude traded firmer on the day as it reached a session high of $80.18/barrel. This was mainly as a result of supply concerns ignited by the draw in US crude oil stockpiles data released on Wednesday. The commodity was trading at $80.13/barrel just after the JSE close.

Volatility in Bitcoin was muted in comparison to the trend that is normally recorded in the coin. Bitcoin was trading at $8315.50 per coin at 17.00 CAT, whilst Ethereum was trading back above $700 per coin, at $704.90 per coin.