Global markets including the JSE retreated on Friday after the USA announced tariffs on $50 billion worth of Chinese goods and services.

China has hinted that it would retaliate to these tariffs which might mark the beginning of an intense trade war between the two global powers. Given the outcome of the G7 summit last week, it is prudent to expect more retaliations and counter moves from some of the USA’s trading partners in the short-term.

Locally, the Rand came under pressure as it slid to a session low of R13.49 against the greenback. This weakness was a result of US dollar strength which saw the US dollar index jump to briefly break above 95 index points. The Rand was trading at R13.49/$ at 17.00 CAT.

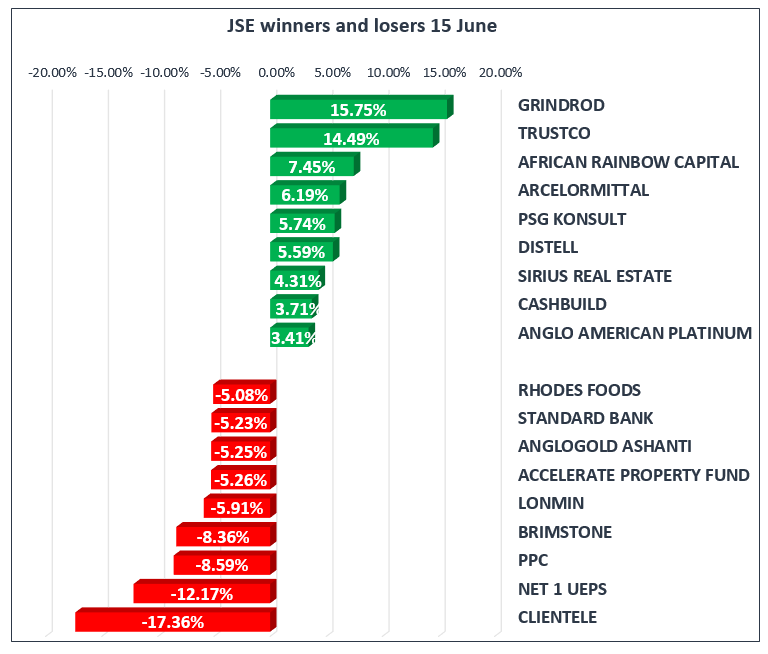

The JSE opened firmer but it ceded all its gains in the afternoon as global sentiment filtered through. PPC Ltd [JSE:PPC] came under significant pressure to end the day 8.59% weaker at R8.06 per share. This was following the release of a trading statement which indicated that they are expecting significant decreases in earnings.

The weaker Rand saw banks trade softer and as a result Standard Bank [JSE:SBK] dropped 5.23% to close at R197.10, while Nedbank [JSE:NED] was 3.94% weaker at R264.95 per share. EOH Holdings [JSE:EOH] lost 4.79% to close at R31.22 per share, whilst Massmart [JSE:MSM] was 1.99% softer at R113.40 per share. Diversified miners, Anglo American PLC [JSE:AGL] and BHP Billiton [JSE:BIL] lost 3.41% and 2.9% respectively.

Grindrod [JSE:GND] jumped 15.75% to close at R9.85 per share ahead of the listing of its shipping business on the NASDAQ which is scheduled for Monday 18 June. Platinum miner, Anglo American Platinum [JSE:AMS] posted gains of 3.41% to end the day at R344.50 per share. Healthcare stocks, Life Healthcare [JSE:LHC] added 2.11% to close the day at R26.56 per share.

The JSE Top-40 index closed the day 1.63% weaker, whilst the broader JSE All-Share Index lost 1.43%. All the major indices closed in the red with the Financials index taking the biggest knock of 2.96%. The Industrials and Resources indices lost 0.66% and 2.19% respectively.

Brent crude dropped by more than 2% to reach a session low of $73.89/barrel as concerns about OPEC raising output remained. The commodity was trading 2.5% weaker just after the close to be recorded at $74.04/barrel.

The spike in the US dollar resulted in Gold weakening by more than 1.5% to reach a session low of $1278.54/Oz. This contrasted with the relatively muted reactions that we have seen in the commodity in the most recent trading sessions. The precious metal was trading at $1281.25/Oz at 17.00 CAT.

Palladium was 1.46% weaker at $995.81/Oz while Platinum was trading at $891.83/Oz, down 1.49% for the day.

Ethereum rose by 4.64% to trade at $495.97/coin at 17.00 CAT, whilst Bitcoin was 1.76% firmer to trade at $6526.80/coin.