Global equity markets including the JSE gained on Tuesday after China’s president struck a positive tone with regards to his country’s position on global trade.

The JSE opened firmer and extended its gains during the course of today’s trading session. Earlier on in Asia, the major indices namely the Nikkei and Hang Seng managed to end the day 0.54% and 1.65% firmer respectively on the back of the same news.

Volatility in the Rand was rife as the local currency swung between a session low of R12.13/$ and a session high of R12.02/$. The strength in the Rand was mainly on the back of US dollar weakness, however the local currency failed to gain enough momentum to break below R12/$. At 17.00 CAT the Rand was trading at R12.04/$.

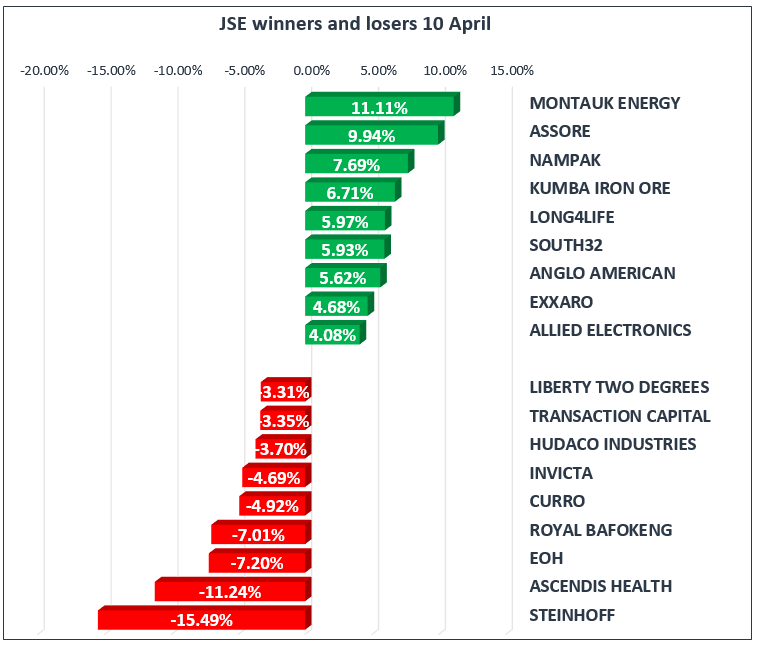

Miners led the gains today with stocks such as Kumba Iron Ore [JSE:KIO], Anglo American PLC [JSE:AGL] and BHP Billiton [JSE:BIL] recording gains of 6.71%, 5.62% and 3.78% respectively. Glencore [JSE:GLN] and Exxaro [JSE:EXX] added 3.56% and 4.68% respectively, whilst South32 [JSE:S32] closed 5.93% firmer.

Barloworld [JSE:BAW] and Bidvest [JSE:BVT] managed to record gains of 3.48% and 3.37% respectively, whilst a mildly firmer Rand saw banks such as Standard Bank [JSE:SBK] and Nedbank [JSE:NED] adding 0.95% and 1.2% respectively. Old Mutual [JSE:OML] managed to add 1.15% whilst its sector peer Sanlam [JSE:SLM] gained 1.32%.

Steinhoff International [JSE:SNH] came under significant pressure as it reached a new all-time low of R2.48 per share. The stock eventually closed at R2.51 per share, down 15.49% for the day. A sell-off also ensued in Ascendis Health [JSE:ASC] which saw the stock losing 11.24% to close at R9.63 per share. EOH Holdings [JSE:EOH] eased after consecutive sessions of significant gains to end the day down 7.2%.

Curro Holdings [JSE:COH] and Stadio Holdings [JSE:SDO] shed 4.92% and 3.14% respectively, whilst Harmony Gold [JSE:HAR] and Sibanye-Stillwater [JSE:SGL] lost 3.07% and 2.65% respectively. Retailers traded softer which saw Mr Price [JSE:MRP], Woolworths [JSE:WHL] and Pick n Pay [JSE:PIK] losing 0.27%, 0.47% and 0.63% respectively.

The JSE All-Share Index eventually closed 1.17% firmer, whilst the JSE Top-40 Index climbed 1.31%. The Resources Index jumped 2.55%, whilst the Financials and Industrials Indices added 0.94% and 0.87% respectively.

Brent Crude jumped by more than 2% to peak at a session high of $70.21/barrel. The commodity pulled back slightly to trade at $70.40/barrel just after the JSE close.

Gold traded relatively mixed mainly on the back of the volatility that was recorded in the US dollar. The precious metal slipped to a session low of $1331.18/Oz before rebounding to trade at $1339.90/Oz at 17.00 CAT.

Palladium rallied in the afternoon session by more than 2.5% to peak at a session high of $958.53/Oz. The metal retraced to trade at $957.42/Oz at 17.00 CAT. Platinum came under pressure as it slid to session low of $926.95/Oz. It was still trading softer at 17.00 CAT at $930.16/Oz.