The JSE slid further on Friday in line with global markets on the back of Donald Trump’s proposed tariffs on steel imports into the USA.

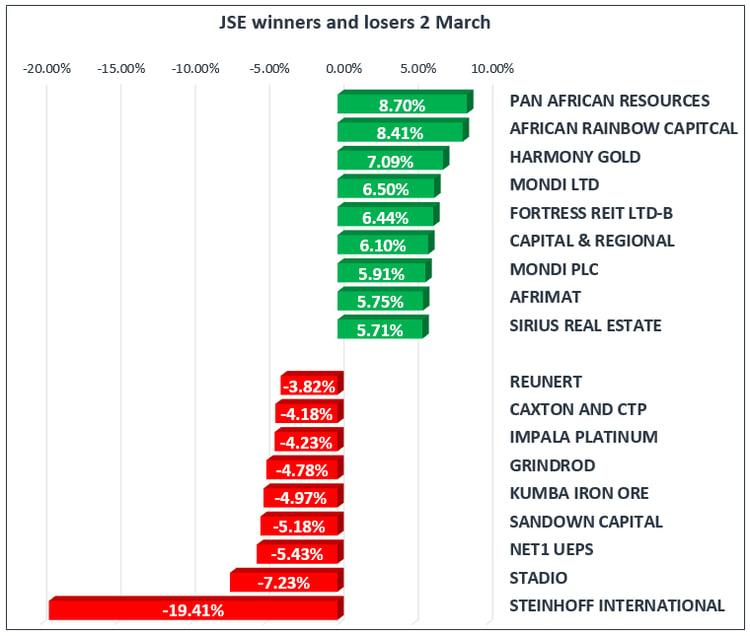

The local bourse recorded a third consecutive session of losses in which losses were led by Steinhoff International [JSE:SNH] which slid further to close at R4.11 per share, down 19.41% for the day. Stadio Holdings [JSE:SDO] and Impala Platinum [JSE:IMP] also came under significant pressure to end the day 7.23% and 4.23% weaker. On the blue chip index Resilient [JSE:RES] lost another 2.27% to close at R62.38 per share, whilst Naspers [JSE:NPN] and MTN [JSE:MTN] shed 1.37% and 1.90% respectively.

Banks were mixed, with Standard Bank [JSE:SBK] and Capitec Holdings [JSE:CPI] losing 0.80% and 1.29% respectively, whilst on the other hand Nedbank [JSE:NED] gained 1.64%.. Nedbank firmed on the back of a solid performance indicated by its full year results for the year ended 31 December 2017 released on Friday morning.

Mondi Ltd [JSE:MND] and Mondi PLC [JSE:MNP] gained on the back of a decent set of group results released on Friday. The stocks ended the day up 6.50% and 5.91% respectively. Harmony Gold [JSE:HAR] and Gold Fields [JSE:GFI] inched up 7.09% and 3.72% respectively on the back of firmer Gold metal prices. Retailer, The Foschini Group [JSE:TFG] gained 2.30% to close at R222.00 per share, whilst Ascendis Health [JSE:ASC] continued on its positive trajectory to end the day up 2.56%.

The JSE All-Share Index ended the day 0.52% weaker after having been down more than 1% in the first hour of trading, whilst the JSE Top-40 Index ended the day 0.59% softer. The biggest loser was the Industrials Index which shed 0.80% whilst the Financials Index was down by 0.02%. The Resources Index bucked the trend to end the day up 0.13%.

Despite the US dollar trading softer on Friday, the Rand also weakened to reach a day’s low of R12.01/$. The US dollar slid to briefly break below 90 index points, reaching day’s a low of 89.886 index points. It was recorded at 90.028 index points just after the JSE close. The USD/ZAR was trading at R11.98/$ at 17.00 CAT.

Gold recovered overnight from Thursday’s lows and subsequently tracked even higher on Friday as the US dollar weakness persisted. The metal managed to claw its way to a day’s high of $1325.49/Oz before retracing to trade at $1322.11/Oz just after the JSE close.

Palladium had a volatile session as it traded within a $20 range and just after the close it was trading at $995.24/Oz, up 0.41% for the day. Platinum was less volatile compared to Palladium, and just after the close it was trading at $968.50/Oz.

Brent Crude was trading in downward trend and it managed a day’s low of $63.35/barrel. At 17.00 CAT it was trading at $63.40/Oz, down 0.67% for the day.

US equity markets opened sharply lower as Donald Trump tweeted earlier, that a trade war was good for the USA. The Dow Jones and S&P500 indices were both down by more than 1% at 17.00 CAT.