The losses on the JSE deepened as it fell for a second consecutive session to close softer on Tuesday.

The local bourse shrugged off the gains in other global markets as it was weighed down by broad based losses across all the major indices, and more particularly from deeper losses in the financials index as well as the industrials index. This contrasted with stocks in Asia which closed mostly higher on Tuesday as well as European counters which edged up marginally. US indices looked to retest their recent all-time highs when US markets opened this afternoon.

Global investors searched for more clues on the “phase one” deal of the current ongoing trade talks between Beijing and Washington D.C as current consensus suggest a partial deal is almost certain. With no economic data being released locally, there was no other catalyst for upside momentum.

On the currency market, the rand traded mostly softer on the day as it fell to a session low of R14.85/$. At 17.00 CAT, the rand had rebounded to trade 0.1% softer at R14.78/$.

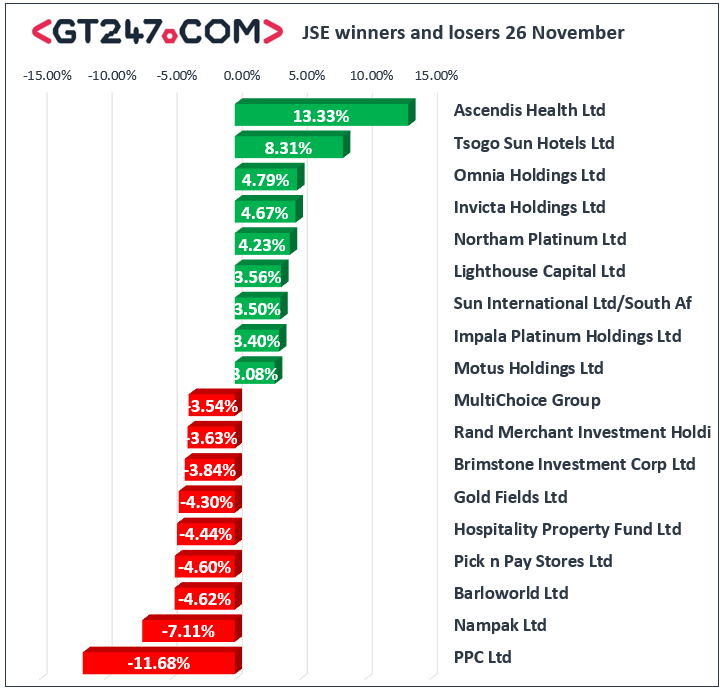

On the JSE, PPC Ltd [JSE:PPC] extended its losses as it fell 11.68% to close at R2.95, while Nampak [JSE:NPK] tumbled 7.11% to end the day at R6.27. Gold miners traded mostly weaker on the day as declines were recorded for Gold Fields [JSE:GFI] which lost 4.3% to close at R74.27, AngloGold Ashanti [JSE:ANG] which fell 3.17% to close at R267.65, and Harmony Gold [JSE:HAR] which dropped 2.49% to close at R45.12. The weaker rand saw rand sensitives such as Pick n Pay [JSE:PIK] drop 4.6% to close at R66.00, FirstRand [JSE:FSR] lost 3.38% to close at R62.25, and ABSA Group [JSE:ABG] lost 3.18% to close at R149.50. Other significant losses on the day were recorded for Barloworld [JSE:BAW] which dropped 4.62% to close at R110.62, Naspers [JSE:NPN] which retreated 2.35% to close at R2177.50, and Bidvest Group [JSE:BVT] which closed at R206.87 after losing 3.12%.

Tsogo Sun Hotels [JSE:TGO] closed amongst the day’s biggest gainers after it advanced 9.42% to close at R3.95. Omnia Holdings [JSE:OMN] was buoyed by its return to profitability which was highlighted in its half-year results. The stock gained 4.79% to close at R31.75. Transaction Capital [JSE:TCP] reported higher earnings in its full-year results which saw the stock gain 3.14% to close at R22.00. Platinum miners gained some traction in today’s session as gains were recorded for Northam Platinum [JSE:NHM] which rose 4.23% to close at R109.00, and Impala Platinum [JSE:IMP] which added 3.4% to close at R115.57. Gains were also recorded for Motus Holdings [JSE:MTH] which climbed 3.08% to close at R72.93, and Aspen Pharmacare [JSE:APN] which closed at R118.62 after adding 1.37%.

The JSE Top-40 index closed 1.3% weaker while the JSE All-Share index lost 1.19%. The Resources index lost a more modest 0.17% while the Industrials and Financials indices dropped 1.45% and 2.35% respectively.

At 17.00 CAT, Palladium had shed 0.1% to trade at $1795.32/Oz, Platinum was up 0.44% at $901.40/Oz, and Gold was 0.01% firmer at $1455.12/Oz.

Brent crude resumed its uptrend in today’s session before it was recorded trading 0.64% firmer at $63.02/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.