Pressure mounted on the JSE on Friday which saw it close weaker in tandem with trends in global markets which traded under pressure.

Concerns over the spread of the coronavirus heightened on Friday as reports of new infections and detections keep surfacing across the globe. A gauge for global stocks indicates this week as the worst week for global stocks in terms of losses since August 2019. With the Chinese equity markets still closed, the main gauges for performance in Asia where the Hang Seng which lost 0.52%, and the Nikkei which advanced 0.99%. Stocks in Europe remained in a slump while US markets were set to open lower despite a firmer close on Thursday.

Emerging market currencies continue to hemorrhage as investors dump riskier currencies in favour of more stable developed market currencies. The rand slumped further in today’s session as it slipped to a session low of R14.97/$. At 17.00 CAT the rand was trading 1.19% weaker at R14.93/$.

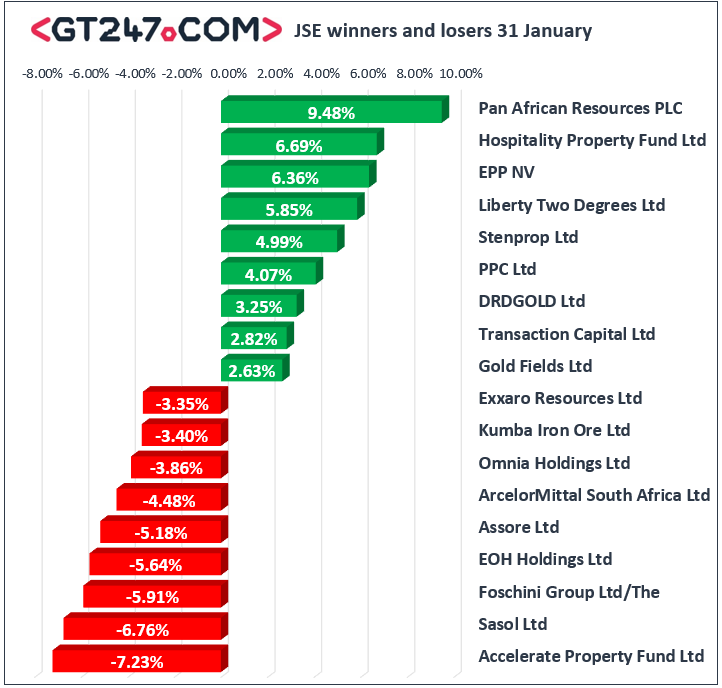

On the JSE, Sasol [JSE:SOL] came under considerable pressure following the release of its half-year trading statement which highlighted decreases in earnings and significant finance charges associated with the Lake Charles Chemicals Project. The stock eventually closed 6.76% weaker at R239.17. The weaker rand resulted in weakness being recorded for rand sensitives such as retailers. Declines were recorded for The Foschini Group [JSE:TFG] which lost 5.91% to close at R137.80, and Mr Price [JSE:MRP] which fell 3.15% to close at R170.12. Financials also struggled with losses being recorded for Nedbank [JSE:NED] which dropped 3.23% to close at R195.71, FirstRand [JSE:FSR] which fell 2.91% to close at R57.80, and Old Mutual [JSE:OMU] which closed at R17.30 after losing 121.77%. Significant losses were also recorded for Exxaro Resources [JSE:EXX] which lost 3.35% to close at R121.77, as well as Bid Corporation [JSE:BID] which fell 3.25% to close at R332.25.

Pan African Resources [JSE:PAN] closed amongst the day’s biggest gainers following the release of its half-year statement in which the company indicated that they are expecting a steep jump in earnings. The stock eventually closed 9.48% higher at R2.54. Listed property stocks recorded decent gains on the day with surges being recorded for Hospitality Property Fund [JSE:HPB] which rallied 6.69% to close at R7.50, as well as EPP NV [JSE:EPP] which climbed 6.36% to close at R17.38. Cement producer PPC ltd [JSE:PPC] rallied 4.07% to close at R2.30, while tobacco producer British American Tobacco [JSE:BTI] gained 1.9% to close at R659.00. Gains were also recorded for DRD Gold [JSE:DRD] which rose 3.25% to close at R9.52, as well as Glencore [JSE:GLN] which closed at R43.76 after gaining 0.69%.

The blue-chip JSE Top-40 index eventually closed 0.95% weaker while the JSE All-Share index lost 0.9%. The biggest decline was recorded for the Financials index which lost 2.13%, while the Industrials and Resources indices dropped 0.64% and 0.67% respectively.

Brent crude dipped below $57/barrel eventually being recorded at $0.85% weaker at $56.84/barrel just after the JSE close.

At 17.00 CAT, Gold was up 0.62% at $1583.18/Oz, Platinum was down 1.75% to trade at $960.46/Oz, while Palladium had slipped 0.57% to $2297.14/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.