The JSE fell on Monday as it tracked other global markets lower which were dragged by increasing violence in Hong Kong, as well as US-China trade concerns.

Protests in Hong Kong have gotten increasingly violent which has investors worried about stability in the region. Donald Trump’s comments that the USA would not completely roll back on tariffs imposed on China also brought back pessimism about the extent or possibility of the roll backs announced last week.

Earlier in Asian markets trading the Hang Seng tumbled 2.62% while the Shanghai Composite Index dropped 1.76%. A downward trend was also dominant in the European trading session as well as US equity futures before the spot market opened.

On the currency market, the rand traded softer to the greenback as it slipped to a session low of R14.96/$. At 17.00 CAT, the rand was recorded trading 0.05% weaker at R14.85/$.

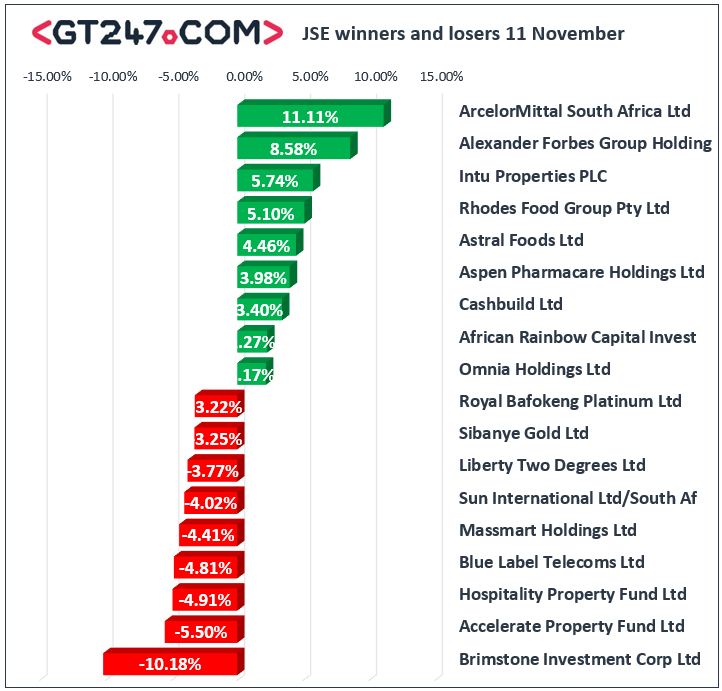

On the local bourse, index heavyweights struggled on the day which dragged the all-share index lower. Retailers came under pressure primarily on the back of the softer rand. Losses were recorded for Massmart [JSE:MSM] which lost 4.41% to close at R44.19, Truworths [JSE:TRU] weakened by 1.42% to close at R49.84, and Shoprite [JSE:SHP] closed at R134.01 after falling 2.76%. Diversified mining giant Anglo American PLC [JSE:AGL] dropped 1.63% to close at R384.18, while its sector peer BHP Group [JSE:BHP] lost 0.97% to close at R324.38. Luxury goods retailer, Richemont [JSE:CFR] slipped 1.6% to end the day at R109.00, while Naspers [JSE:NPN] retreated 0.85% to close at R2131.73. Despite releasing a rather upbeat set of half-year results, Vodacom [JSE:VOD] eventually closed 0.36% softer at R134.51 after a volatile session. Multichoice Group [JSE:MCG] shed 0.06% to close at R133.42 despite the release of a positive set of interim results.

ArcelorMittal [JSE:ACL] rallied 11.11% to close at R1.90 as it closed as one of the day’s biggest gainers. Alexander Forbes [JSE:AFH] also found some momentum as it surged 8.58% to close at R5.95. UK focused listed property stock Intu Properties [JSE:ITU] recorded gains of 5.74% to close at R6.82, while its sector peer Hammerson PLC [JSE:HMN] climbed 2% to close at R53.93. Aspen Pharmacare [JSE:APN] was buoyed by the release of news that its disinvesting from its operations in Japan which will result in proceeds of 400 million euros. The stock climbed 3.98% to close at R117.70. Rand hedge, British American Tobacco [JSE:BTI] added 1.47% to close at R553.52, while telecoms provider MTN Group [JSE:MTN] gained 1% to close at R97.78.

The JSE All-Share index eventually closed 0.96% lower while the JSE Top-40 index fell 0.85%. The Resources index was the biggest casualty of the day as it lost 1.13%. The Industrials and Financials indices lost 0.93% and 0.47% respectively.

At 17.00 CAT, Palladium was down 1.75% to trade at $1712.44/Oz, Gold was only 0.05% softer at $1459.07/Oz, and Platinum was 0.61% weaker at $881.60/Oz.

Brent crude traded mostly flat on the day before it was recorded trading 0.06% softer at $62.44/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.