The local bourse inched higher on Wednesday as global stocks took a breather following consecutive sessions of weakness.

The rebound in global stocks was primarily on the back of a jolt in crude oil prices following extensive declines since Monday. Strong gains were primarily recorded in Europe and the USA where stocks rose by more than 1% on average. The outlook was rather mixed in Asia where the Nikkei shed 0.74%, while the Shanghai Composite Index and the Hang Seng inched up 0.82% and 0.42% respectively.

Locally, Statistics South Africa released inflation data for the month of March which came in lower than anticipated. CPI YoY which was recorded at 4.1% from a prior recording of 4.6%, while CPI MoM was recorded at 0.3% from a prior recording of 0.5%. The rand surged on the back of this data to peak at a session high of R18.71/$, however it retreated to trade 0.13% firmer at R18.94/$ at 17.00 CAT.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

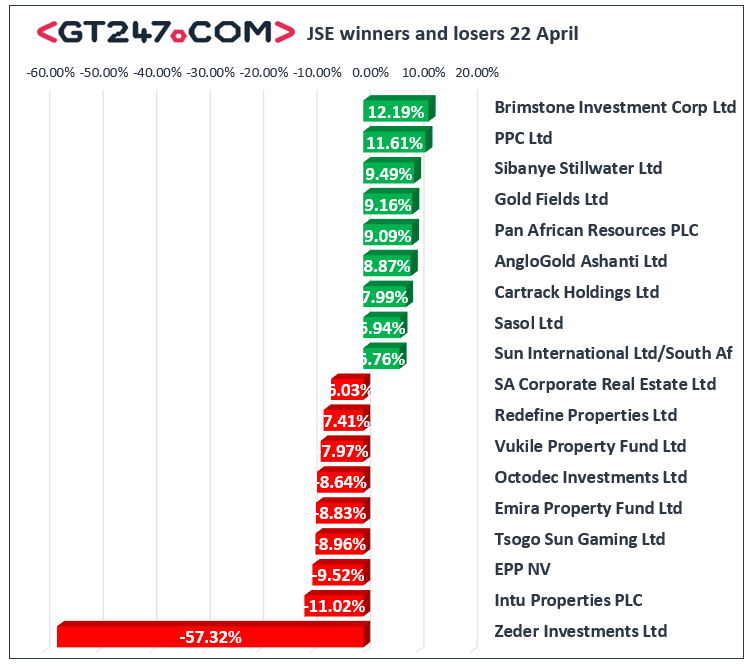

On the JSE, Sibanye Stillwater [JSE:SSW] released its suite of annual statements and a no change statement, which saw the stock rally 9.49% to close at R32.30. Gold miners were buoyant in today’s session led by gains in Gold Fields [JSE:GFI] which advanced 9.16% to close at R133.60, as well as Harmony Gold [JSE:HAR] which climbed 6.21% to close at R57.83. Retailers advanced on the back of the firmer rand as gains were recorded for The Foschini Group [JSE:TFG] which added 2.88% to close at R75.40, and Pick n Pay [JSE:PIK] which advanced 3.34% to close at R59.09. Mining giant Anglo American PLC [JSE:AGL] rose 1.14% to close at R315.05, while BHP Group [JSE:BHP] advanced 1.44% to close at R293.25. Sasol [JSE:SOL] also staged a recovery as it closed at R58.84 after gaining 6.94%.

Zeder Investments [JSE:ZED] was trading ex-special dividend today therefore it declined 57.32% to close at R1.75. Listed property stocks constituted the bulk of the day’s biggest losers as declines were recorded for Intu Properties [JSE:ITU] which fell 11.02% to close at R1.13, Emira Property Fund [JSE:EMI] which lost 8.83% to close at R6.40, and Growthpoint Properties [JSE:GRT] which closed at R13.00 after losing 4.97%. Financials traded mostly on the day as declines were recorded for Standard Bank [JSE:SBK] which lost 4.26% to close at R92.57, and Nedbank [JSE:NED] which lost 3% to close at R87.59. Losses were also recorded for Exxaro Resources [JSE:EXX] which lost 3.03% to close at R102.31, and for Discovery Ltd [JSE:DSY] which closed at R80.30 after losing 2.3%.

The JSE All-Share index eventually closed 1.01% firmer while the JSE Top-40 index gained 1.17%. The Financials index came under pressure as it lost 1.15%, while the Industrials and Resources indices gained 0.54% and 3.14% respectively.

The recovery in brent crude prices saw the commodity trading 7.04% higher at $20.69/barrel just after the JSE close.

At 17.00 CAT, Platinum was flat at $748.97/Oz, Palladium was up 0.94% at $1949.87/Oz, and Gold had gained 1.32% to trade at $1708.68/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.