The JSE edged higher on Thursday as it took a leaf from the surge in European and US equities.

The local bourse managed to maintain its gains despite a weaker showing in Asian markets following the release of a lower Chinese Caixin Services PMI number compared to the previous recording. Global investors had their primary focus on the Bank of England for the bank rate announcement in which the bank decided to keep the official bank rate unchanged at 0.10%. US markets also shrugged off a higher than expected unemployment claims number as tech stocks led gains across the 3 main indices.

Locally, there was disappointment in terms of economic data following the release of the SACCI Business Confidence index data for April which came in at 77.8, compared to a forecast of 89.2. The rand weakened following the release of this data, but it was still trading firmer on the day. At 17.00 CAT, the rand was trading 0.38% firmer at R18.65/$.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

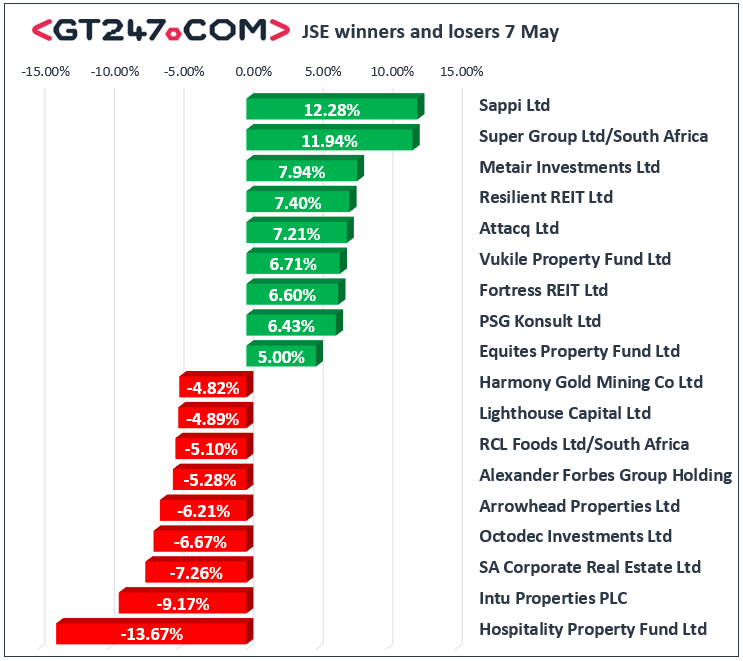

On the JSE, Sappi [JSE:SAP] closed as one of the day’s top gainers following the release of its quarterly results. This saw the stock surge 12.28% to close at R24.14. Super Group [JSE:SPG] climbed 11.94% to close at R17.25, and Murray and Roberts [JSE:MUR] added 3.33% to close at R5.27. Some of the listed property stocks were also buoyant on the day as gains were recorded for Resilient [JSE:RES] which added 7.4% to close at R35.69, Vukile Property Fund [JSE:VKE] gained 6.71% to close at R5.25, and Equities Property Fund [JSE:EQU] which closed at R16.80 after gaining 5%. Coal miner Exxaro Resources [JSE:EXX] advanced 2.36% to close at R108.50, while Anglo American PLC [JSE:AGL] added 4.86% to close at R336.68. Gains were also recorded for Woolworths Holdings [JSE:WHL] which climbed 2.18% to close at R28.60, and for Multichoice Group [JSE:MCG] which closed at R86.45 after gaining 1.5%.

SA Corporate Real Estate [JSE:SAC] came under significant pressure as it slipped 7.26% to close at R1.15. while Arrowhead Properties [JSE:AHB] fell 6.21% to close at R1.36. Gold miner, DRD Gold [JSE:DRD] tumbled 4.79% to close at R16.90, while Harmony Gold [JSE:HAR] fell 4.82% to close at R61.39. Sibanye Stillwater [JSE:SSW] dropped 1.97% to end the day at R34.75, while Impala Platinum [JSE:IMP] lost a modest 0.41% to close at R105.00. Losses were also recorded for British American Tobacco [JSE:BTI] which lost 2.55% to close at R678.00, as well as Massmart [JSE:MSM] which closed at R23.12 after falling 2.61%.

The JSE Top-40 index eventually closed 0.31% softer while the JSE All-Share index shed 0.38%. The Industrials index closed 0.1% softer while the Financials and Resources indices gained 0.83% and 0.82% respectively.

Brent crude was trading 2.66% higher at 30.51/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.65% firmer at $1696.53/Oz, Platinum had inched up 0.58% to trade at $758.43/Oz, and Palladium was up 1.09% at $1820.17/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.