Equity markets traded mixed on Friday as uncertainty around impeachment proceedings in the US continued to hold the market back. Fears around a potential derailment of a SIN-US trade pact emerged on Thursday sending shivers in the markets. The Brexit conundrum has taken another twist this week as Boris Johnson continued to lose favour amongst his peers in the House of Commons after the Supreme Court overruled the prorogation of Parliament. The Bank of England made inferences that it would have to cut interest rates further even if the United Kingdom was able to leave the European Union with a deal which sent the Pound spiralling.

Asian markets were mixed on Friday as the Nikkei and the Hang Seng eased 0.77% and 0.335 respectively, whilst the Shanghai 300 and the ASX 200 advanced 0.3% and 0.58% respectively. All eyes are on the US now as political uncertainty continues to hamstring Asian markets.

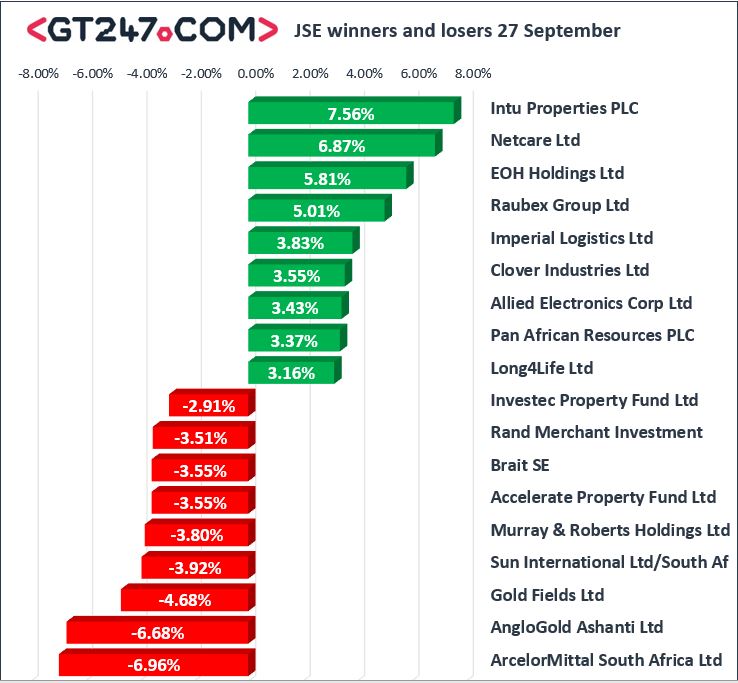

Gains were recorded in Intu Properties Plc on Friday, which gained 7.56% on the day to trade at 854c. Notable gains were recorded in Netcare Limited [JSE:NTC], EOH Holdings Ltd [JSE:EOH], Raubex Group Ltd [JSE:RBX] and Imperial Logistics Ltd [JSE:IPL] which gained 6.87%, 5.81%, 5.01% and 3.83% respectively. Clover [JSE:CLR], the branded foods and beverage business seems to be on track for the much talked about take over, the share price has rallied higher towards the proposed buyout price of 2500c per ordinary share.

The mining share took the brunt pf sellers on Friday as ArcellorMittal [JSE:ACL], AngloGold Ashanti [JSE:ANG], and Gold Fields Ltd [JSE:GFI], shed 6.96, 6.68% and 4.68% respectively. Pressure on domestic stocks persist as local data points continue to disappoint as the ailing economy struggles to find a break.

The JSE All-Share index closed 0.17% weaker whilst the JSE Top-40 index retreated 0.15%. The Financials index eased on the day to trade 0.84% lower. The Industrial and Resource indices were mixed as the industrials eased 0.02% whilst the resources gained 0.27% respectively.

The local unit eased on Friday to trade at a session low of R15.11 to the greenback. The Rand was trading at R15.08 to the dollar, R16.52 to the Euro and R18.57 to the British Pound.

Brent crude continued to trade lower on the day as a barrel of Brent crude was changing hands at $61.29 at 17:00 CAT. Tensions in the middle east continue to wreak havoc in the oil markets as oil traders remain on edge.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.