The JSE closed weaker on Tuesday following a rather lukewarm trading session where the bourse traded mostly flat.

South African manufacturing production quarter-on-quarter data disappointed as it contracted by 1.6% which was in contrast to the estimated expansion of 0.3%, whilst the year-on-year data was in line with market expectations.

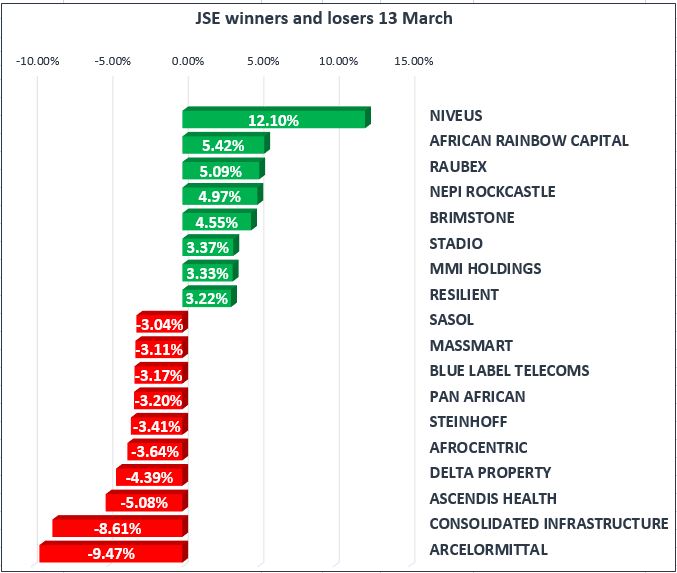

Aspen [JSE:APN] came under significant pressure after the open as it slid by more than 9% to reach a session low of R229.87 per share. The stock recouped most of the losses to close at R247.50 per share, down 2.96% for the day. ArcelorMittal [JSE:ACL] and Consolidated Infrastructure [JSE:CIL] ended amongst the day’s biggest losers as they lost 9.47% and 8.61% respectively.

Retailers Truworths [JSE:TRU], Woolworths [JSE:WHL] and Massmart [JSE:MSM] traded softer despite the Rand firming, as they weakened by 1.93%, 2.68% and 3.11% respectively. Dis-Chem [JSE:DCP] lost 2.52% to close at R34.41 per share, whilst British American Tobacco [JSE:BTI] and Sasol [JSE:SOL] lost 1.97% and 3.04% respectively.

Following yesterday’s slide, listed property stocks NEPI Rockcastle [JSE:NRP], Resilient [JSE:RES] and Fortress B [JSE:FFB] clawed back some of the losses to end the day up 4.97%, 3.22% and 2.13% respectively. Capitec [JSE:CPI] and First Rand [JSE:FSR] led the financials as they gained 2.81% and 2.49% respectively, whilst MMI Holdings [JSE:MMI] and Discovery [JSE:DSY] gained 3.33% and 1.60% respectively.

Index heavyweights Naspers [JSE:NPN] and BHP Billiton [JSE:BIL] added 0.73% and 0.21% respectively, whilst Glencore [JSE:GLN] ended the day 2.34% firmer. Holding companies Remgro [JSE:REM] and Rand Merchant Holdings [RMH] gained 0.65% and 1.93% respectively.

The broader JSE All-Share Index eventually closed 0.19% weaker, whilst the blue chip Top-40 Index lost 0.13%. The Financials Index firmed by 0.54% on the back of the stronger Rand, however the Industrials and Resources Indices eased by 0.32% and 0.76% respectively.

A volatile trading session ensued for the US dollar on Tuesday. The greenback came under pressure after the release of US inflation data which came out in line with market expectations and slid even further after the opening of US equity markets. As a result the Rand strengthened against the greenback to a session high of R11.75/$, before retracing to trade at R11.78/$ at 17.00 CAT.

Gold traded softer for the better part of today’s session however it gained some momentum when the US dollar came under pressure. The precious metal reached a session low of $1314.17/Oz before spiking to briefly trade in the green. It was trading at $1323.38/Oz just after the close.

Platinum traded mostly flat from the open but it also gained momentum following the release US inflation data. The metal peaked at a session high of $971.34/Oz but just after the close it had retraced to trade at $967.18/Oz. Palladium also opened and traded relatively flat, however it gained more than 1.5% after the release of US data to reach a high of $995.76/Oz. Palladium was trading marginally softer at $994.93/Oz just after the close.