The JSE closed weaker in today’s session as the Rand weakened to lows last recorded in April.

Earlier on the Rand faced significant pressure as it weakened to an intra-day low of R13.71 against the greenback. However the local currency managed to bottom out as the US Dollar lost some ground against major currency pairs. Just after the JSE closed the Rand was trading at R13.53/$.

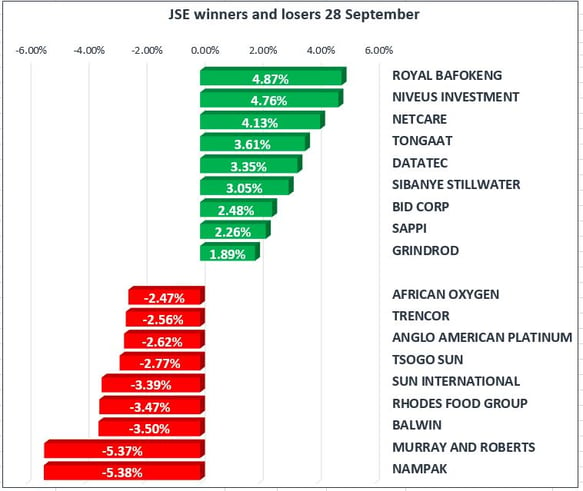

Diversified miners Anglo American PLC (JSE:AGL) and BHP Billiton (JSE:BIL) were among the losers today as they lost 0.73% and 1.51% respectively. Hospitality stocks Sun International (JSE:SUI) and Tsogo Sun (JSE:TSH) also came under pressure as they lost 3.39% and 2.77% respectively. The Resources Index came under pressure due to relatively subdued metal commodity prices. This resulted in JSE listed miners Anglo American Platinum (JSE:AMS) and Kumba Iron Ore (JSE:KIO) shedding 2.62% and 2.19% respectively. Nampak (JSE:NPK) was the biggest loser of the day as it lost 5.38%. The exception to the trend was Sibanye-Stillwater (JSE:SGL) which tracked higher on the day to close 3.05% firmer.

Major gainers on the day included Royal Bafokeng Platinum (JSE:RBP) which jumped 4.87%, whilst Sappi (JSE:SAP) gained 2.26%. Rand-sensitive stocks Woolworths (JSE:WHL) and Barclays Africa (JSE:BGA) inched up on the back of the pullback the in the Rand to end the day up 1.11% and 0.88% respectively. Netcare (JSE:NTC) and Tongaat Hulett (JSE:TON) also fared well on the day as they gained 4.13% and 3.61% respectively.

The JSE All-Share Index eventually closed down 0.40%, whilst the blue chip Top-40 Index was down by 36%. All of the major indices closed in the red with the Industrials Index closing down 0.22%, the Resources Index was down by 0.75% and the Financials Index lost 0.40%.

Locally, StatsSA released PPI data and the year-on-year number was recorded at 4.2% on the back of an estimate 4.1%. This is up from a prior recording of 3.6%. The month-on-month number decreased to 0.4% from a prior recording of 0.5%, but this was higher than the forecast of 0.3%.

In the USA the major focus was on the final estimate of GDP quarter-on-quarter which came in better than expected. The annualized quarter-on-quarter number came in at 3.1%, which was slightly better than the forecasted 3.0%. Initial Jobless Claims numbers were slightly worse than expected as the claims from last week climbed to 272 000 claims on the back of a forecast of 270 000 claims. Initially the US Dollar did not react much to this data as it continued on its downward trend, but it started to gain some steam towards the close of the JSE.

Gold firmed from yesterday’s close to peak at $1286.93 per ounce before it was recorded at $1283.93 per ounce just after the JSE closed. Platinum and Palladium traded mostly flat and failed to gain any significant upside momentum. Palladium was trading at $931.85 per ounce just after the JSE closed, whilst Platinum was recorded at $918.30 per ounce.

Brent Crude remained steady as it managed to track back above $58 per barrel to peak at $58.65 per barrel. Just after the JSE closed it was trading at $58.34 per barrel.