The JSE retreated on Wednesday led by losses on the resources index on the back of relatively weak mining production numbers and weaker rand metal commodity prices.

South Africa’s mining production numbers YoY for the month of May disappointed as they came in at -1.5% which was worse than the forecasted contraction of 0.6%. MoM mining production expanded by 3.0% which beat the anticipated growth of 1.8%. Manufacturing production YoY recorded a modest growth of 1% from a prior recording of 4.3%, while MoM it contracted by 1.5% from a prior recording of a 2.5% expansion.

Rand metal commodity prices fail mainly on the back of the stronger rand which strengthened against the greenback. The rand surged along with other emerging market currencies as it peaked at a session high of R13.85/$. At 17.00 CAT, the rand was trading 0.29% firmer at R13.93/$.

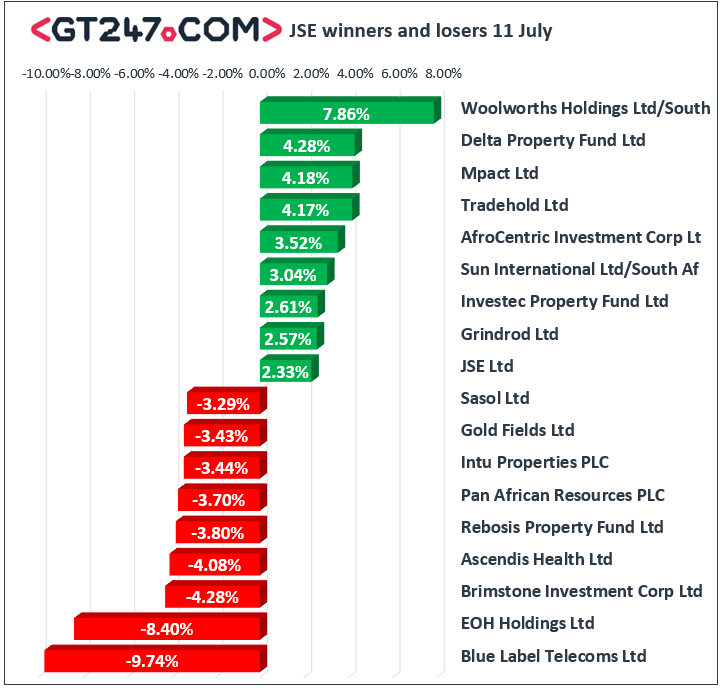

The local bourse retreated despite US markets retesting their all-time highs as well as gains being recorded in Europe. Woolworths [JSE:WHL] surged mainly on the back a positive trading statement for the year ended 30 June 2019. The stock climbed 7.86% to close at R52.95. Other retailers also firmed on the back of the stronger rand with gains being recorded Mr Price [JSE:MRP] which gained 2.01% to close at R197.00, as well as Truworths [JSE:TRU] which added 1.94% to end the day at R67.70. Delta Property [JSE:DLT] also recorded significant gains on the day as it closed 4.28% firmer at R1.95, while Investec Property Fund [JSE:IPF] managed to post gains of 2.61% to close at R15.75.

EOH Holdings [JSE:EOH] tumbled to end the day 8.4% weaker at R22.24, while Blue Label Telecoms [JSE:BLU] fell 9.74% to close at R3.52. Index mining giant Anglo American PLC [JSE:AGL] dropped 0.99% to close at R373.51, while its sector peer lost 1.4% to close at R345.95. Oil and gas producer Sasol [JSE:SOL] lost 3.29% as it closed at R325.34, while rand hedge British American Tobacco [JSE:BTI] closed at R507.09 after dropping 2.56%. Other significant losses on the day were recorded for Ascenids Health [JSE:ASC] which lost 4.08% to close at R4.70, Intu Properties [JSE:ITU] dropped 3.44% to R13.20, and Gold Fields [JSE:GFI] which lost 3.43% to close at R74.41.

The JSE Top-40 index closed 0.59% weaker while the broader JSE All-Share index lost 0.56%. All the major indices eventually closed lower on the day. Industrials dropped 0.04% weaker, Financials dropped 0.71%, and Resources lost 1.54%.

At 17.00 CAT, Platinum was down 0.37%, Gold had lost 0.69%$ to trade at $1409.12/Oz, and Palladium had fallen 1.79% to trade at $1563.00/Oz.

Brent crude rallied overnight, and it was sill trading relatively firmer for most of the day. It was trading 0.18% weaker at $66.94/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.