The local bourse barely closed firmer on Monday after it relinquished most of its earlier gains.

The JSE tried to take a leaf from the earlier trend in Asian equities were the Hang Seng surged 1.11% while the Shanghai Composite Index gained 0.98%. The Nikkei was closed for a holiday. Stocks in Europe struggled, while US stocks advanced ahead of the signing of a partial trade deal with China. With no economic data being released locally, the JSE looked for direction from other global markets.

The US dollar advanced against a basket of major currencies which also saw the rand lose ground against it in the afternoon session. The local currency quickly fell to a session low of R14.45/$ towards the JSE close, before it was recorded trading 0.58% weaker at R14.44/$ at 17.00 CAT.

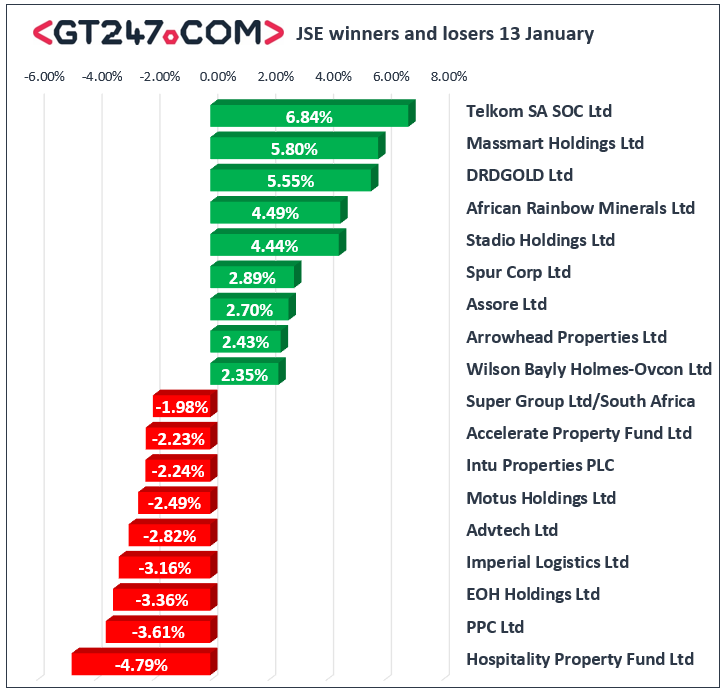

On the JSE, gains were led mostly by resources which saw DRD Gold [JSE:DRD] rally 5.55% to close at R8.75, while African Rainbow Minerals [JSE:ARI] surged 4.49% to close at R173.50. Diversified miner, South32 [JSE:S32] gained 2.81% to close at R27.76, while commodity trading giant Glencore [JSE:GLN] added 1.39% to close at R45.17. Massmart [JSE:MSM] surged following the announcement that it had recently conducted a store optimization project that highlighted some underperforming stores, and as a result the company will be embarking on downsizing exercise which will result in store closures and retrenchments. Massmart eventually closed 5.8% weaker at R51.64. Gains on the day were also recorded for Telkom [JSE:TKG] which rallied 6.84% to close at R35.00, and Naspers [JSE:NPN] which gained a more modest 0.57% to close at R2389.03.

Ascendis Health [JSE:ASC] came under significant pressure as it plummeted 10.32% to close at R1.39. Listed property stocks traded mostly weaker which saw losses being recorded for Accelerate Property Fund [JSE:APF] which lost 2.23% to close at R1.75, Hyprop Investments [JSE:HYP] which retreated 1.61% to close at R55.49, and Fortress REIT [JSE:FFB] which closed at R7.87 after dropping 1.01%. MTN group [JSE:MTN] closed 1.28% weaker at R82.60 despite the announcement that their case of a USD2 billion tax demand in Nigeria had been withdrawn. Losses were also recorded for Motus Holdings [JSE:MTH] which lost 2.49% to close at R79.23, FirstRand [JSE:FSR] which weakened by 1.46% to close at R59.32, and Truworths [JSE:TRU] which closed at R46.70 after falling 1.46%.

The JSE All-Share index eventually closed 0.15% firmer, while the JSE top-40 index gained 0.19%. the Financials index came under considerable pressure as it shed 0.96%. The Industrials and Resources indices gained 0.34% and 0.62% respectively.

Brent crude continues to retreat as tensions in the Gulf moderate. The commodity was trading 0.66% weaker at $64.58/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.76% weaker at $1550.22/Oz, Platinum was down 0.78% at $970.68/Oz, and Palladium had firmed 0.46% to trade at $2126.50/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.