The JSE barely closed firmer on Wednesday following another session in which the local index gave up earlier gains towards the close.

Stocks were mixed in Asia as losses were recorded for the Japanese Nikkei and the Shanghai Composite Index which shed 0.33% and 0.41% respectively, while the Hang Seng managed to add 0.08%. In Europe stocks traded mostly firmer despite gains being relatively modest. US markets opened significantly lower benchmark Treasury yields continued to fall, with the 30-year yield in particular dropping to an all-time low. This is characteristic of the current risk-off sentiment which has seen investors move in droves into safe-haven assets.

On the currency market the rand slumped against the greenback as it broke out above R15/$ to peak at a session low of R15.18/$. At 17.00 CAT, the rand was trading 1.17% weaker at R15.08/$.

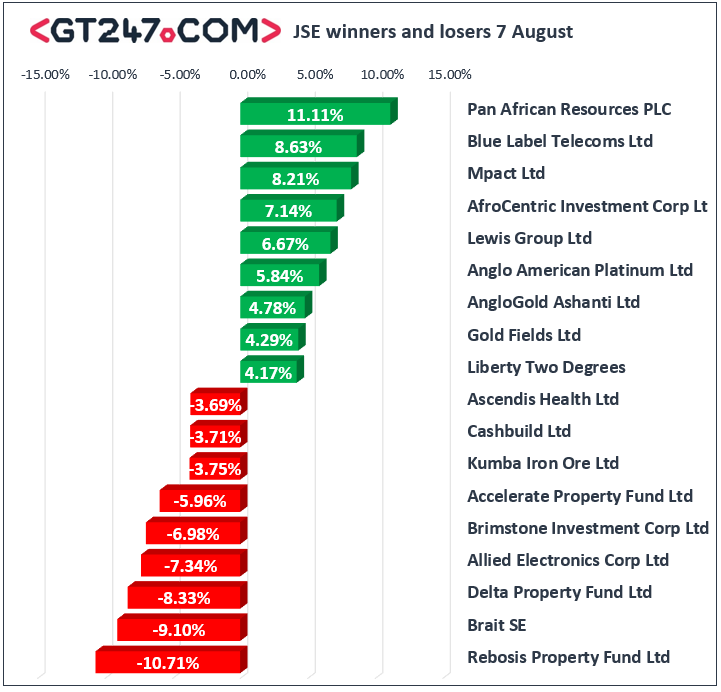

Pan African Resources [JSE:PAN] led the gains on the local bourse as it advanced 11.11% to close at R2.50. Blue Label Telecoms [JSE:BLU] was buoyed by the release of a cautionary statement announcing its roaming agreement with MTN. The stock closed the day 8.63% firmer at R4.53. The flight to safety has seen gold miners on the JSE rising over the past couple of sessions. DRD Gold [JSE:DRD] surged 7.61% to close at R5.80, AngloGold Ashanti [JSE:ANG] rose 4.78% to close at R320.01, and Gold Fields [JSE:GFI] closed at R90.85 after gaining 4.29%. Platinum miner Anglo American Platinum [JSE:AMS] rallied 5.91% to end the day at R882.62, while Impala Platinum [JSE:IMP] surged by 3.21% to close at R78.85. Rand hedge British American Tobacco [JSE:BTI] managed to post gains of 2.45% to close at R553.48, while Richemont [JSE:CFR] climbed 1.85% to R119.99.

Of the day’s losers, Brait [JSE:BAT] lost further ground as it slipped 9.1% to close at R12.78. Kumba Iron Ore [JSE:KIO] weakened on the back of softer iron ore prices which saw the stock close at R409.64 after dropping 3.75%. Retailers took another tumble in today’s session as the rand weakened further. Shoprite [JSE:SHP] fell 2.87% to close at R153.45, Mr Price [JSE:MRP] lost 2.46% to close at R174.73, while Massmart [JSE:MSM] dropped 2.15% to close at R46.78. Glencore [JSE:GLN] fell following the release of its half-year report which highlighted significant profit decreases in its African copper and cobalt mines. The stock retreated 2.19% to close at R41.14.

The JSE All-Share index had a late save as it closed 0.15% firmer while the JSE Top-40 index added 0.13%. The Financials index was the only major index to close in the red as it lost 0.92%, while the Industrials and Resources indices managed to add 0.44% and 0.34% respectively.

At 17.00 CAT, Palladium was down 1.07% to trade at $1431.45/Oz, Platinum was up 1.13% to trade at $862.20/Oz, and Gold had gained 1.82% to trade at $1501.46/Oz.

Brent crude plunged further following the US crude inventories report which showed a significant rise in stockpiles. The commodity was trading 3.41% lower at $56.93/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.