The JSE has traded mostly flat on Thursday as the industrials and resources indices pulled in opposite sides before a late rally saw it close firmer.

Global markets were digesting the Fed’s interest rate decision which was announced on Wednesday in which it cuts the benchmark rate by 25 basis points to 2%. Fed chairman, Jerome Powell reiterated that the central bank was not in an interest cutting cycle, which sent stocks into a spiral as investors had priced in significant monetary policy loosening. Focus now shifts to the US non-farm payrolls data which is expected to be released on Friday.

US markets tumbled following the Fed’s press conference overnight, and subsequently Asian markets also opened and traded mostly softer on Thursday. The Shanghai Composite Index lost 0.83% while the Hang Seng shed 0.76%. The Japanese Nikkei was marginally firmer as it inched up 0.09%.

On the currency market, the rand tumbled as the National Treasury announced an increase in the weekly bond issuance. With the situation at Eskom deteriorating further and increasing economic risks, the case for Moody’s to downgrade South Africa’s sovereign rating is possibly quite high. The local currency slipped to a session low of R14.56/$ before it was recorded trading 1.39% weaker at R14.53/$ at 17.00 CAT.

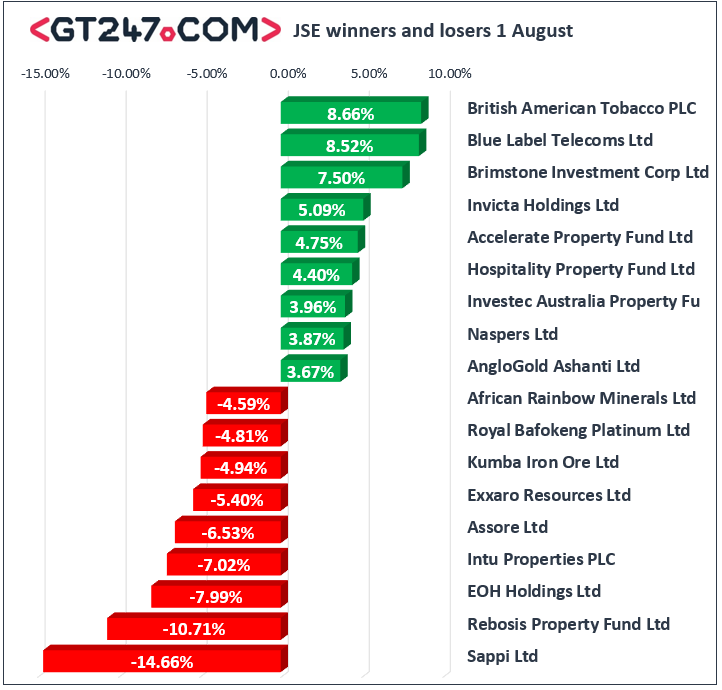

British American Tobacco [JSE:BTI] surged in today’s session following the release of the its half-year results which were mostly positive as the company recorded increases in revenue and earnings. The share eventually closed 8.66% higher at R556.79. Telecoms provider Blue Label Telecoms [JSE:BLU] climbed 8.52% to close at R3.95, while its sector peer Vodacom [JSE:VOD] managed to gain 1.04% to end the day at R118.88. Index heavyweight Naspers [JSE:NPN] helped lift the All-Share index towards the close as it closed 3.87% firmer at R3643.00, while another index large cap Richemont [JSE:CFR] rose 2.24% to close at R125.45. Other significant gainers on the day included AngloGold Ashanti [JSE:ANG] which gained 3.675 to close at R263.14, and Sasol [JSE:SOL] which rose 1.95% to close at R316.80.

Sappi [JSE:SAP] plummeted on the day following the release of the company’s quarterly results which showed a decline of 25% in earnings per share. The stock closed 14.66% weaker at R44.53. EOH Holdings [JSE:EOH] slipped further as it fell 7.99% to end the day at R16.36, while Brait [JSE:BAT] lost another 3.47% to close at R11.39. Intu Properties [JSE:ITU] which tumbled by more than 30% on Wednesday, lost another 7.02% as it closed at R7.81. Coal miner Exxaro Resources [JSE:EXX] fell 5.4% to close at R158.32, while Kumba Iron Ore [JSE:KIO] closed at R452.91 after dropping 4.94%.

The JSE All-Share index closed 0.77% higher while the JSE Top-40 index gained 1.05%. The Resources and Financials indices lost 1.48% and 0.175 respectively, however the Industrials surged to close 2.44% firmer.

At 17.00 CAT, Palladium had tumbled 5.62% to trade at $1433.85/Oz, Platinum was down 1.93% to trade at $848.45/Oz, and Gold was 0.12% firmer at $1414.39/Oz.

Brent crude slipped from its overnight highs to trade 2.24% weaker at $63.62/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.