The JSE climbed higher in line with broadly stronger global markets.

The rand weakened on Thursday, closing at R12.70 against the dollar. The rand had weakened to R17.74 from R17.54 following a shock announcement from the ANC conference that the party had endorsed a resolution to allow land expropriation without compensation.

South African bonds managed to stay firm, with the 10-year R186 maintaining a yield 8.69% from Wednesday’s 8.66%

The JSE All-Share index closed 1.27% higher, matched by the blue-chip Top 40 gaining 1.59%. The market was driven by industrial stocks gaining 1.88%, and resources 1.70%. Financials took a breather an eased off 0.13% due to a weaker rand.

Steinhoff International [JSE:SNH] continued to slip further, dropping 1.08% to R4.57 after it was apparent that the company would need to liquidate assets in order to finance operations going forward due to a constrained credit position. The business has constrained working capital, and have not yet detailed the extent of the accounting irregularities, adding to investor and lender uncertainty.

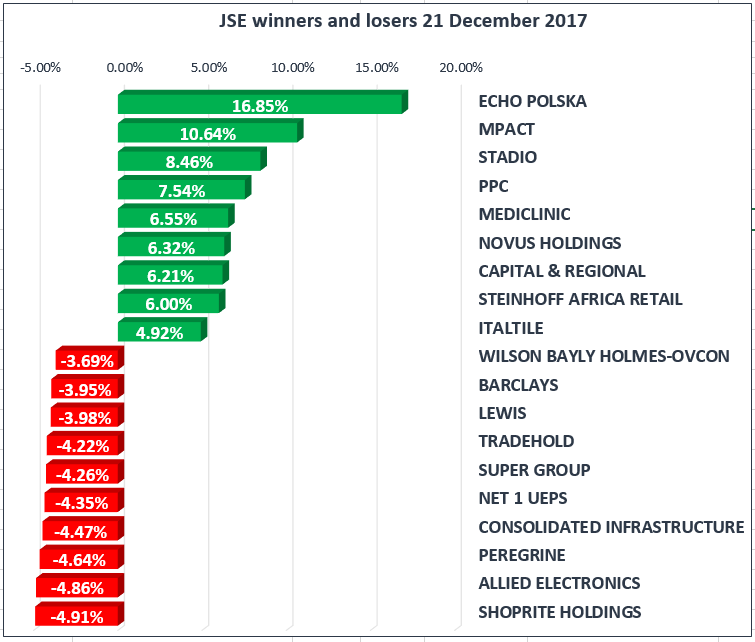

Shoprite [JSE:SHP] fell 4.91% to R206.15 as Steinhoff International Holdings’s biggest shareholder, Christo Wiese, sold over R3.3billion in the retailer to fund margin calls on Steinhoff.

Echo Polska Properties [JSE:EPP] recovered 16.85% following the resignation of one of its non-executive directors after he was arrested in Poland on Wednesday.

In the US, Wall Street opened higher on Thursday after data showed U.S. economy grew at its fastest pace in more than two years in the third quarter, while investors eyed gains from sweeping corporate tax cuts passed by Congress this week.

The Dow Jones Industrial Average was up by 0.35 percent. The S&P 500 gained 0.19 percent, to 2,684.62. The Nasdaq Composite added 12.03 points, or 0.17 percent, to 6,972.99.