The JSE closed weaker on Friday after a relatively muted trading session where equities couldn’t gain significant momentum.

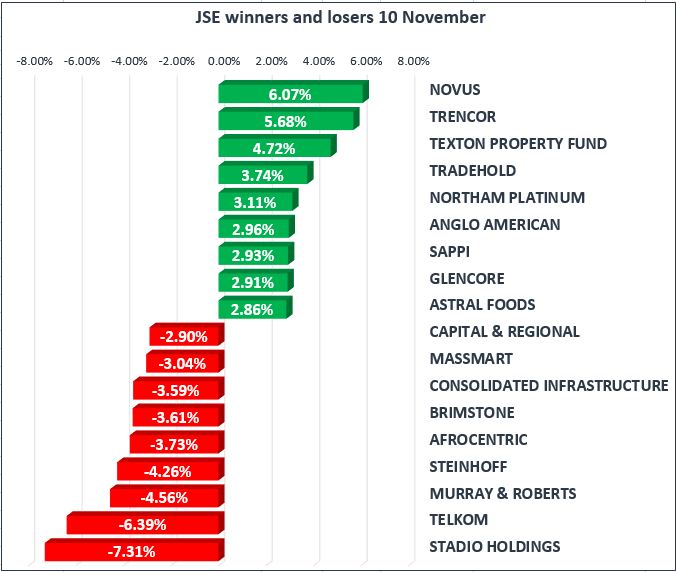

Blue chip stocks Sappi [JSE:SAP] and Sasol [JSE:SOL] recorded decent gains to close the day up 2.93% and 1.14% respectively. Glencore [JSE:GLN], which had a minor selloff yesterday recovered some of those losses to close the day up 2.91%. The trend was similar in the miners which saw stocks such as Harmony Gold [JSE:HAR], African Rainbow Minerals [JSE:ARM] and BHP Billiton gaining 2.13%, 0.81% and 1.43% respectively.

Rand hedges British American Tobacco [JSE:BTI] and Mondi PLC [JSE:MNP] gained on the back of the weaker Rand to close the day up 0.37% and 0.90% respectively. This wasn’t the same for all Rand hedges as Richemont [JSE:CFR] and Steinhoff [JSE:SNH] shed 2.46% and 4.26% respectively. The drop in Richemont was rather surprising given the decent results indicated in the six months results released on Friday morning.

Despite a weakening Rand some banking stocks closed in the green as evidenced by First Rand [JSE:FSR] and Barclays Africa [JSE:BGA] which closed up 0.46% and 0.06% respectively.

Telkom [JSE:TKG] shed 6.39% after the release of their six months results for the year ended 30 September 2017. The results indicated a decrease in both basic earnings per share and headline earnings per share of 7% and 7.4% respectively.

Other notable moves lower were from Stadio [JSE:SDO] and ArcelorMittal [JSE:ACL] which lost 7.31% and 8.85% respectively. Retailers came under more pressure today due to the weaker Rand and notably, Truworths [JSE:TRU] and Massmart [JSE:MSM] closed the day 1.47% and 3.04% lower respectively.

The JSE Top-40 Index eventually closed up 0.17% whilst the broader All-Share Index gained 0.14%. The Industrials Index lost 0.88% whilst the Financials Index gained 0.21%. The Resources Index was the biggest gainer of the day as it jumped 1.62%.

The Rand slid against the greenback to reach a low of R14.41/$. It recovered slightly to trade at R14.32/$ at the close of the JSE. The South African benchmark 10-year treasury yield had increased to 9.355% when the JSE closed.

Metal commodities were softer in today’s session with Palladium in particular having the biggest drop as it lost more than $10/Oz to reach an intra-day low of $997.25/Oz. Platinum also followed a similar trend but it did recover to trade in the green by the time the JSE closed. Platinum miners were mixed as Anglo American Platinum [JSE:AMS] lost 0.06%, but Lonmin [JSE:LON] managed to gain 1.64%. Platinum was trading at $938.92/Oz when the JSE closed, whilst Palladium was recorded at $1001.81/Oz.

Gold also traded flat as it failed to get a clear direction. The precious metal was recorded at $1284.61/Oz when the JSE closed after only having managed to peak at $1287.52/Oz.

Brent Crude remained mostly unchanged as it traded within a similar range to the previous day. The commodity only managed to reach a high of $64.27 per barrel before it retraced to trade at $64.04 per barrel when the JSE closed.