The JSE cooled on Wednesday as the market took a breather from recent highs. A weaker close from Tencent and a firmer rand saw the local market open weaker.

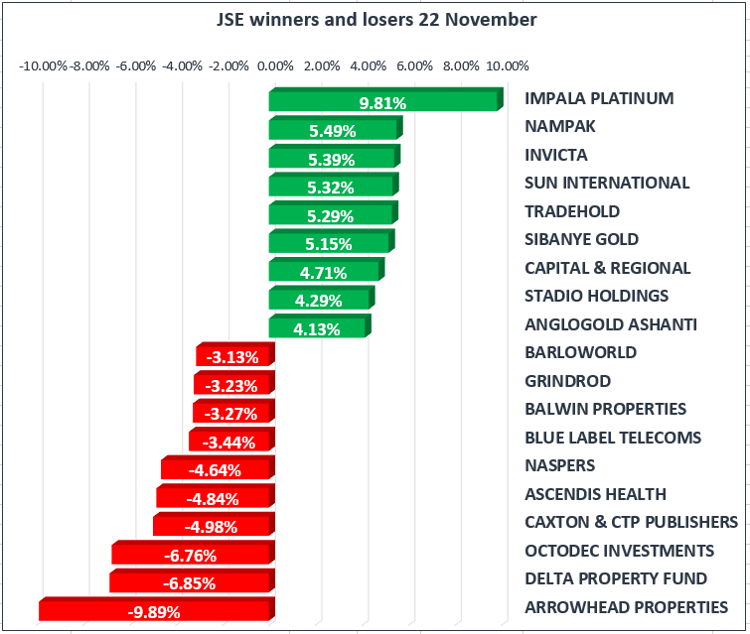

The JSE All-Share Index softened from Tuesday’s fresh all-time highs by 0.75% while the blue-chip Top 40 slipped 1.04%. The move lower was defined by a 4.64% drop in Naspers [JSE:NPN] which closed at R3900.10 per share. Anglo American Plc [JSE:AGL] closed 1.78% lower at R267.90

Naspers had recently hit an all-time high, closing above R4000 as the share price rode the coattails of its Chinese investment, Tencent. The share price was not helped by the rand firming 0.88% to R13.84 against the greenback – reducing the rand value of its foreign earnings.

Impala Platinum [JSE:IMP] closed 9.81% higher at R42.41 following an announcement that Mark Munroe, a highly respected professional in the platinum industry, will join Impala to take control of the group’s troubled Rustenburg operations.

Tsogo Sun [JSE:TSH] gained 3.58% to R21.10 a share after the Gaming and hotel group reported a 10% drop in first-half adjusted headline earnings to R754m, partly as a result of consumers having little disposal income. Total income in the six months to September was up just 1% to R6.4bn, after net gaming win dropped by 3% to R3.56bn. The interim dividend declared was down 6% to 32c per share

Local headline consumer inflation eased to 4,8% y-o-y in October from 5,1% in September in line with our and the market’s expectation. Nine of the twelve categories surveyed recorded softer annual price increases in October.

On a monthly basis; consumer prices increased by 0,3% in October as the food and non-alcoholic beverages and transport categories as well as the residual contributed 0,1 percentage points each

Both consumer and producer inflation are expected to remain below the Reserve Bank’s 6% upper target range for the remainder of the year and into 2018. This and the fact that underlying economic activity remains weak and confidence still fragile means that there is room for the Reserve Bank to cut rates. However, this will be dependent on the trajectory of the rand, which is likely to remain volatile ahead of credit rating agency updates and the ANC’s elective conference in December.

Brent Crude oil gained 0.32% to trade at $62.77/bbl while gold climbed 0.66% to $1289/Oz.